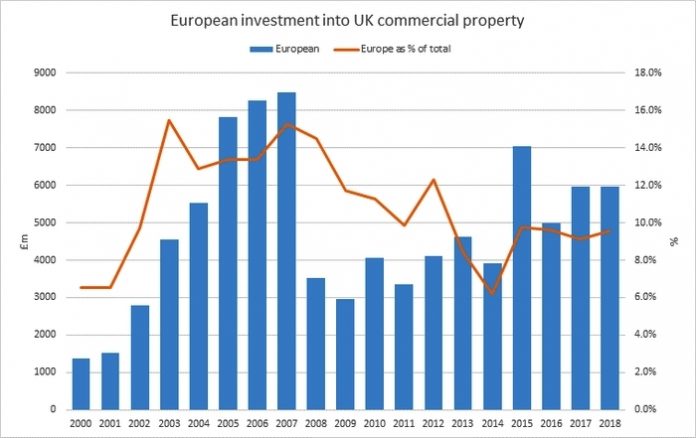

European investors have spent a total of £16.9 billion on UK commercial property between 2016 – 2018 and have invested well above the long term average of £4.8bn per year since the EU referendum in 2016, according to Savills.

Data from the international real estate advisor shows that despite European investment volumes dipping to £5 billion in 2016, 2017 and 2018 saw a period of recovery with investment hitting £5.9 billion per year; 27% above the ten year average of £4.7 billion. As a result, the 2017/2018 period was the strongest two year period for European investment into the UK since 2006/2007.

According to the firm, the top investors between 2016-2018 were Deka and Union (Germany), Pandox (Sweden) and Norges (Norway).

Savills notes that while Europe’s 12% share of total investment is lower than the highs of 17% recorded in 2007, this has been because of the dominance of Asian investment over the last couple of years, accounting for 16% and 21% of the market in 2017 and 2018 respectively.

Mat Oakley, head of commercial research at Savills, comments: “UK commercial property has remained attractive for European investors despite the slight blip caused by the EU referendum. The diversity of asset classes and regional markets means that the country has continued to be a destination of interest to a range of investors whether they be opportunistic, long term or for development purposes. With Brexit on the doorstep it is difficult to predict what will happen, however there may be significant opportunities for developers and those looking to capitalise on a currency play.”