Three quarters of lenders expect UK commercial property values to fall in 2019, typically predicting a drop of more than 2.5% according to the latest Real Estate ‘Market Trend Analysis’ report from Link Asset Services. Only 8% expect commercial real estate values to rise.

The report, which analyses the UK’s largest dataset of lenders’ sentiment regarding real estate, also reveals that 61% of lenders expect residential property values will fall, reinforcing the forecast of negative house price growth by the OBR in the recent Spring Statement.

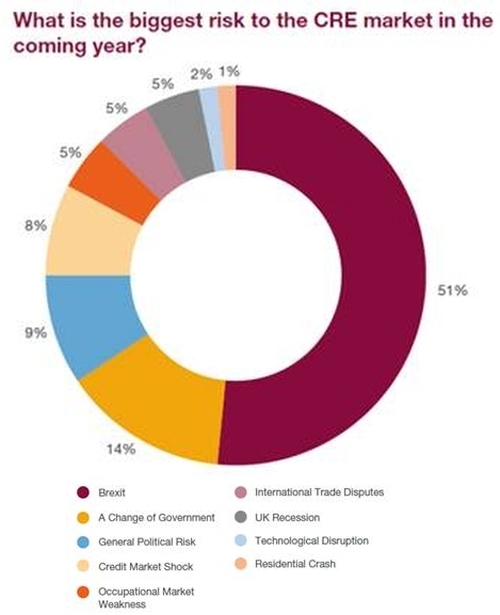

Political uncertainty is weighing heavily, with 74% citing political risks as the biggest threat to the commercial real estate (CRE) market in the coming year. Among those citing political risks, Brexit was by far the largest concern (51%).

Lenders’ pessimism is reflected in a reduced number expecting their new lending to grow. The number expecting loan volumes to increase fell by 18% compared to 2018, and the number expecting to increase the size of their origination teams fell by 10%.

Loan to values have also fallen by a modest 2% since 2018, reflecting concerns over elevated risk. Meanwhile, pricing on higher risk categories of lending has continued to rise. The report also demonstrates that lenders are focusing on their core market sectors and regions – a further sign of caution.

The findings also demonstrate that lenders are looking for bigger ticket purchases to finance and that some of the best loan pricing is only available on these more significant transactions. The maximum loan amount has increased exponentially for investment loans from an average of £134m in 2017, to £154m in 2018 and up to £226m in 2019.

There are now also five lender categories which can lend a maximum of £500m or more on investment loans – North American banks, pension funds, debt funds, insurance companies, and Pfandbrief banks.

The provision of longer-term debt has also continued to grow with supply perhaps outweighing demand for loans of 10 or more years, with more lenders than ever are offering these very long-term loans. However, 3 to 5 year loans remain the most keenly supplied type of funding.

James Wright, Head of Real Estate Finance at Link Asset Services said: “Confidence has turned to caution at the start of 2019. Brexit has already weighed heavily on UK real estate market, and political risk is by far lenders’ largest concern. We are seeing many taking a far more cautious approach as a result, with fewer expecting to do more business, and many falling back into their core markets and products. It looks like, in the next 12 months, we’ll see lenders take a ‘softly, softly’ approach until there is greater clarity around the UK’s relationship with the EU, and economic and political fears calm.”