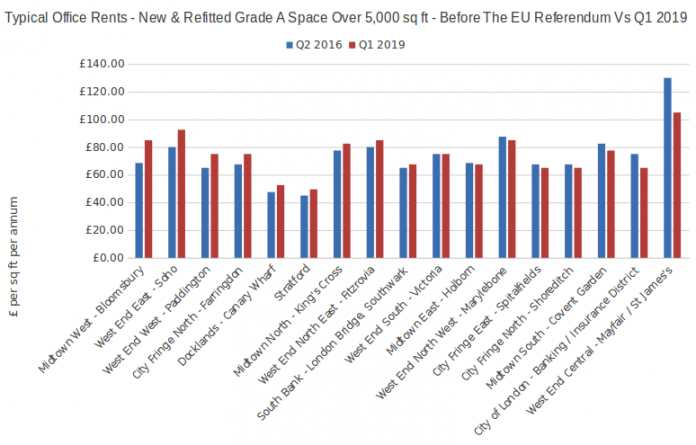

Carter Jonas, the national property consultancy, has announced that it has published new research on the London office market, specifically an analysis of rents before the June 2016 referendum and rents today. The research reveals some quite unexpected trends and highlights those areas of London that have fared better than others.

Bloomsbury has seen rents for new Grade A office space increase the most since the June 2016 referendum – up by 24 percent, from, typically, £68.50 per sq ft to £85.00 per sq ft per annum.

Mayfair and St James’s, by contrast, have fared the worst since the Brexit vote. Rents for new Grade A space in these districts have fallen from, typically, £130.00 per sq ft to £105.00 per sq ft per annum – representing a decline of 19 percent.

The South Bank is the only non-Elizabeth Line connected sub-market where rents have increased since the referendum – up 3.8 percent – underpinned by an acute undersupply of new Grade A space.

Michael Pain, Head of Tenant Advisory, Carter Jonas, comments:

“The increase in Bloomsbury rents has been driven by a combination of factors including the development of the Tottenham Court Road Elizabeth Line station and improvements to the public realm, including traffic restrictions around the Centre Point building. These initiatives have coincided with the development of new Grade A buildings that have set a new rent benchmark in the area.”

“By contrast, tenants’ reluctance to pay rents over £100.00 per sq ft per annum and the shift in demand, north and eastwards to Elizabeth Line connected districts, including Paddington and Soho, are factors that have led to the decline in rents in Mayfair and St James’s.”

Pain added: “The Elizabeth Line has become the focus of office demand across London. From Paddington in the West to Canary Wharf and Stratford in the East, rents in those areas that benefit from a Crossrail station have typically increased by over 10% since the referendum – and by 15% in Paddington and Soho.”

Rents for new Grade A mid-rise office space in the City core have declined by 13% since the June 2016 referendum, and now stand at, typically, £65.00 per sq ft per annum.

Dan Francis, Head of Carter Jonas’ Research Team, commented:

“The decline in City office rents is far less severe than many commentators forecast immediately after the referendum – due to better than expected take up, particularly from the legal, insurance, technology and serviced office sectors. Further, the mass exodus of banking and finance jobs from the City to Frankfurt and Paris that was forecast by many at the time of the referendum has not materialised.”