According to the latest Savills Programme and Cost Sentiment Survey* (S.P.E.C.S.), there remains pressure on input costs but tender price inflation remains stable in Q1 2018 as contractors continue to absorb price increases in order to build order books ahead of Brexit.

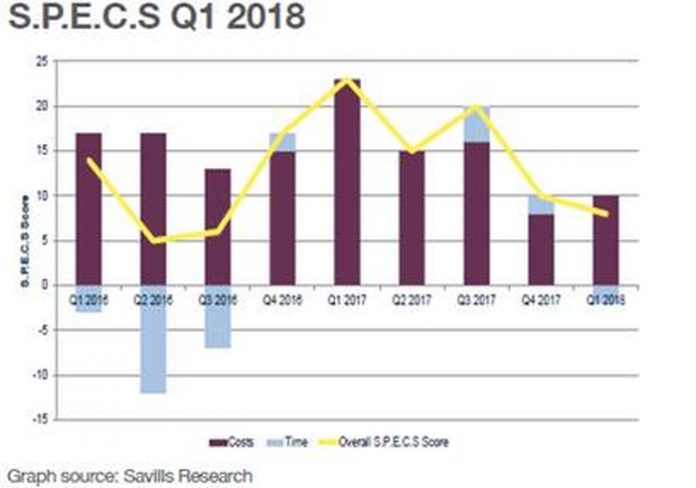

The overall S.P.E.C.S score for Q1 2018 is eight (a score above zero demonstrates that costs and timescales are generally rising, whereas a score below zero indicates a fall)**, which is the lowest quarterly score since the results of the EU referendum was announced in June 2016. A return to these levels is an indicator that ongoing uncertainty is continuing to impact on both costs and timescales across all sectors.

According to data from Gardiner & Theobald, tender price inflation is set to be just 1% for 2018. Savills notes that, even though input costs such as labour and steel are rising, contractors are trying to build order books for 2019 and onward, assuming that both developers and occupiers will be less willing to commit to new projects given current economic headwinds.

In regards to timescales, Savills has found that varying property sectors and geographies are faring in remarkably different ways which in turn is having an impact on new programme delivery and fit-out. For example, logistics in particular is seeing significant demand for build-to-suit and speculative development, which has resulted in an increase in pressure on programme delivery, especially for small to mid-box schemes as pipelines continue to build. Whilst a similar story can be seen in the residential sector, in contrast the office and retail markets remain largely unaffected by timescales as development stays muted.

Simon Collett, head of building & project consultancy at Savills, comments: “2018 continues to be an interesting year for the construction industry as we are seeing pressure on input costs but tender price inflation remains relatively stable. External factors such as US trade tariffs and Brexit will undoubtedly influence those costs into 2019 and beyond, but what this will look like in practice remains to be seen.”

* The survey is based on sentiment recorded by Savills specialist project managers

** The survey, which is based on 48 separate indicators on asset type and geography, tracks sentiment regarding the cost of construction, costs of fit-out and associated time scales for all grades and geographies of commercial and residential real estate across the UK.