OCCUPIER OVERVIEW

Q1 2018 started off with a good level of new enquiries recorded in January and with some of the pre-existing demand from 2017 finally selecting properties. This included Ericson’s move from Guildford in March into the 38,000 sq ft Thames Tower in Reading. The South M25 area saw more activity at the newly developed Prospero in Redhill with NUS and Shawbrook Bank joining Morrisons Solicitors and Plan Insurance. The stock starved North M25 area continues to attract investor and developer interest with Seven Capital buying the 53 Clarendon Road, Watford mixed Office and Residential development site from LIM. Whilst take up for the South East looks to be broadly in line with the Q1 5 year average of circa 750,000 sq ft we are yet to see some of the larger 50,000 sq ft + requirements such as Virgin Media, KPMG, and Sanofi, finally decide on their preferred options – which providing this happens in the next few months should bode well for 2018 full year take up.

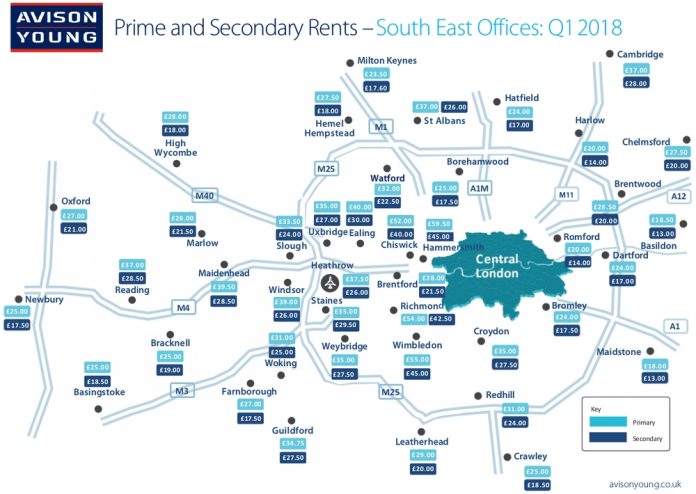

For occupiers the best opportunities lie in the towns that have seen significant speculative development. This has led to levels of short term over supply, which is resulting in landlords offering more flexible leases and generous incentive packages while maintaining headline rents.

INVESTMENT OVERVIEW

Prime yields remain steady at circa 5.25%, underpinned by Floreat’s recent acquisition of the Shipping Building, Hayes at a yield of 5.01% and Newham Borough Council’s purchase of 51-63 London Road Rehill at a yield of 5.5% in 2017. The yield gap between core town centre offices against out of town business park locations, continues to widen as institutional investors move away from single buildings on business parks, due to the weaker reletting prospects and high cost of refurbishment.

Local authorities continue to purchase South East offices in their drive for secure income to fund services, making full use of the Governments Public Works Loans Board debt facility. A total of £445m of Council acquisitions were recorded in 2017, representing approximately 13% of the yearly investment volume. Local authorities have consistently demonstrated their buying power, often bidding in direct competition with UK institutions for well-let good quality assets.

Office to residential conversions under permitted development (PD) rights remain an attractive offer to developers and investors, who see significant short-term profits to be gained. The PD market has also moved into the realm of buying short-term income assets with potential to obtain PD and exit thereafter; as opposed to a straight forward vacant possession purchase. An example of this was Stonegate Home’s purchase of the Circa building in Bracknell. In light of such competitive demand, some institutions are using PD as an exit route for non-core secondary assets, as was the case with the Xerox Building in Uxbridge.

In terms of the outlook ahead, our view is ‘best in class’ assets will continue to perform well with yields hardening in line with the major UK cities. Whilst the Brexit negotiation may cause uncertainty and caution for shorter-term income buildings, there are plenty of cash-rich investors who take the view of this being a significant value-add opportunity.