Mark Callender, Head of Real Estate Research, Schroders, comments:-

Last year was a good year for office markets outside London. Occupier demand recovered from the hiatus caused by the EU referendum in 2016 and office development remained under control, with completions running at around half their previous peak in 2008-2009 (source CBRE). Furthermore, an increase in residential conversions helped to cut the amount of surplus office space, particularly in southern England. As a result, almost all cities saw a fall in vacancy in 2017 (Aberdeen was the main exception) and prime office rents rose in Birmingham, Bristol, Cambridge, Cardiff, Edinburgh, Oxford and Leeds.

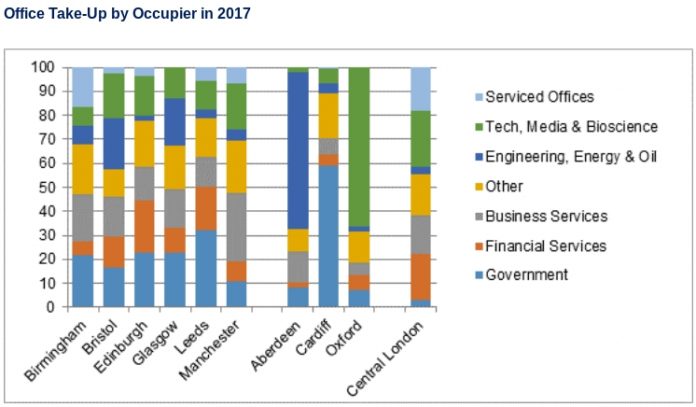

The chart shown above looks in detail at the composition of occupier demand in the big six regional office markets, three smaller cities and central London in 2017. While the percentages for a single year can be skewed by one, or two big lettings, the figures nevertheless reveal some interesting variations. First, the government generally plays a bigger role in regional office markets than in London, although the percentages in certain cities were exaggerated last year (e.g. Cardiff, Leeds) by some large one-off lettings to HMRC, which is consolidating and closing many of its offices in smaller cities and towns.

Second, despite the difficulties of HBOS and RBS during the global financial crisis, Edinburgh remains an important financial centre with strengths in fund management and custodian services. Third, the tech and media sectors are not only thriving in London, but also outside the capital. Manchester has developed into an important centre for media, Bristol has a cluster of robotics firms and Leeds is a hub for on-line gambling. In addition, Oxford is developing into a major life sciences hub, as pharmaceutical companies re-locate their R&D teams there in order to collaborate with the university.

Finally, the surge in demand from serviced office providers (e.g. The Office Group, WeWork) which was a feature of the London market last year, has only just begun in the regions. The serviced office sector accounted for 18% of take-up in central London in 2017, but just 5% across the rest of the UK. Birmingham was the only regional city where the share of serviced offices exceeded 10%.

The strength of the occupier market is echoed by the investment market. The total value of office transactions outside London increased by 18% to £9.4 billion in 2017 (source Property Data Ltd) and there was strong interest from a wide range of both domestic and foreign investors, including capital from China, Germany, Japan, the Middle East, South Korea and the USA. Consequently, prime office yields declined to 4.75%-5.25% by the end of last year (source JLL) and yields on good quality offices fell to 5.5%-6.0%. However, regional offices continue to offer a significant premium over City of London and West End offices with prime yields at end-2017 of 4.25% and 3.5%, respectively.

Turning to the future, we anticipate that regional office rents will be broadly stable through 2018-2019. The domestic focus of most occupiers means there is less risk than in London that demand will be disrupted by Brexit and rents should also be underpinned by the recent fall in vacancy and low level of new building. Looking further ahead, we expect that office rents outside London will start to rise again from 2020 onwards, particularly in those cities with diverse economies, strong universities and good infrastructure such as Brighton, Bristol, Cambridge, Leeds, Manchester, Milton Keynes, Oxford and Reading.