According to the latest Savills Programme and Cost Sentiment Survey* (S.P.E.C.S), sentiment around construction costs fell in Q4 2017 as development pipelines remain limited across all sectors despite strong occupational activity. This slowdown can be attributed to uncertainties around future trading agreements in light of ongoing Brexit talks.

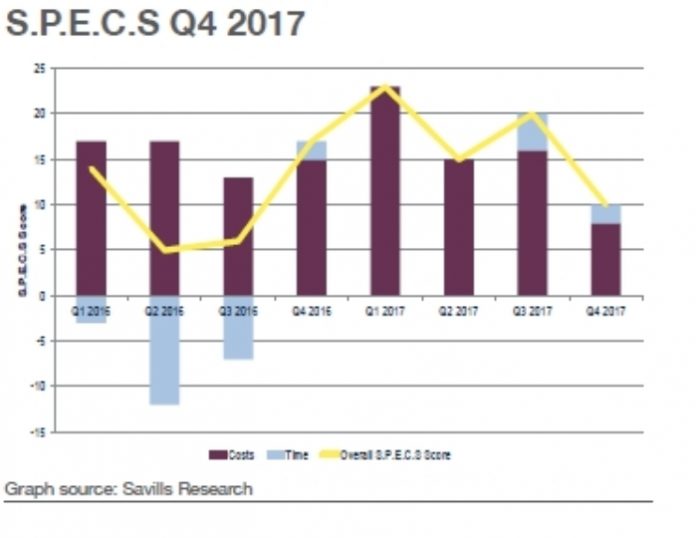

The overall S.P.E.C.S score for Q4 2017 was 10 (a score above zero demonstrates that costs and timescales are generally rising, whereas a score below zero indicates a fall)**, which is the lowest quarterly score since the third quarter of 2016 when the market was still comprehending what the impact of Brexit would be on tenant demand and future development. The return to these levels is an indicator that these impacts have started to be realised.

Commercial occupational markets largely defied expectations in 2017, for example figures from Savills show that both the City and West End exceeded their long term average annual take-up levels of office stock hitting 7.3 million sq ft (678,192 sq m) and 4.8 million sq ft (445,934 sq m) respectively. The same can also be said of the logistics and regional office markets, which have also seen take-up surpass long term averages by as much as 26%.

However, Savills notes that positive take-up in the logistics and regional office markets have largely been characterised by a number of big single unit transactions skewing the figures. As a result, developers have scaled back plans for new product leading to a fall in development pipelines across all sectors. This in turn has seen a decrease in new construction contracts with pricing reacting accordingly as contractors bid for a slowing workload.

Savills anticipates that these reduced costs coupled with shorter timescales will see developers take advantage of these favourable conditions and push the button on future speculative development.

Simon Collett, head of building & project consultancy at Savills, comments: “Given the lagging nature of construction and market cycles, Brexit could start to see pricing fall and construction time scales decrease, which in turn will present opportunities for developers prepared to build in under supplied markets.”

* The survey is based on sentiment recorded by Savills specialist project managers

** The survey, which is based on 48 separate indicators on asset type and geography, tracks sentiment regarding the cost of construction, costs of fit-out and associated time scales for all grades and geographies of commercial and residential real estate across the UK.