The Eurozone economy performed above expectations in 2017, with the IMF forecasting that GDP growth for the year will be 2.1%, its highest level in a decade. Although Eurozone growth may ease slightly in 2018, the consensus is that it will remain close to 2.0%.

The strong European economic recovery has come despite a backdrop of political uncertainty, with France and Germany both holding dramatic elections in 2017. A government has not yet been formed following September’s German elections and, should coalition talks fail in January, fresh elections may be called. The European political agenda for 2018 also includes general elections in Italy in March and Sweden in September. Meanwhile, the progress of the Catalan independence movement will be monitored closely, and uncertainty in the Barcelona property market may cause investors and occupiers to increasingly gravitate to Madrid as a relative safe haven.

Despite improving economic growth, the European Central Bank is expected to keep interest rates on hold at their current record lows until 2019. Government bond yields are likely to edge upwards during 2018, but the margins to property yields should remain attractive. There is the potential for further moderate prime yield compression in select European markets in 2018, but a general stabilisation of yields is anticipated by the year-end. Interest rate rises may start to put upward pressure on prime yields from 2019.

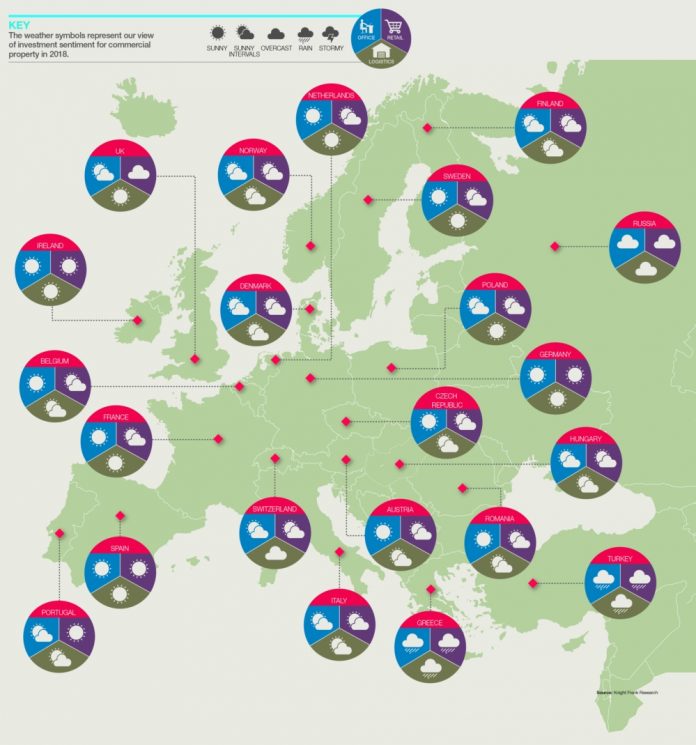

Provisional data for 2017 suggests that European commercial property investment volumes will beat 2016’s total of €216 billion, but remain some way below the market peak of 2015, when over €250 billion was invested. Knight Frank expects 2018 transaction volumes to be similar to 2017. Significant amounts of capital continue to be allocated to real estate, and the increasing prevalence of large-scale platform and portfolio deals will help to support investment volumes.

Investment opportunities

Rental growth hotspots: As the real estate cycle progresses, investors will increasingly need to look to rental growth, rather than continued yield compression, to drive returns. Hotspots are likely to include markets where rental increases have been relatively slow to come through in the current cycle, particularly Amsterdam and Madrid, both of which are seeing rental growth gain momentum. Although the German markets appear to be further ahead in the rental cycle, the fundamentals for growth – high occupier demand, constrained supply and limited development – are especially strong in Berlin and Munich.

Flexible offices: Flexible workspace and co-working is now a phenomenon. Technology, the growth in self- employment and evolving workforce demands are redefining the traditional workspace. The growing appetite for flexible offices is permeating across European markets, with London, Berlin and Paris witnessing the strongest growth. The sector will continue to expand, as new styles of workspaces are developed to service a growing variety of occupier needs.

Urban logistics centres: The European logistics sector has significant investment appeal due to its relatively high yields, income-producing qualities and the impact of the booming e-commerce sector. Online retailing is causing structural changes to demand, particularly by generating an increased need for urban logistics centres used for last-mile delivery. Combined with the current scarcity of logistics property in cities, this has created an attractive supply/demand dynamic for both investors and developers.