The UK industrial property market remained robust in Q3, propped up by growth in the manufacturing sector, according to Cushman & Wakefield’s latest UK Logistics and Industrial Market Outlook report.

After a strong start to the year, take-up of logistics and industrial space slowed to almost 3.2 million square feet in Q3, 20% lower than the same nine months in 2016, and 60% below the five-year average of 7.5 million square feet.

A lack of e-commerce take-up contributed to the fall – accounting for just 10% of all take-up, largely due to a drop in Amazon’s leasing activity in the quarter. Meanwhile, the manufacturing sector has been very active, accounting for over 40% of Q3 take-up. The automotive industry made the largest contribution, with noteworthy contributions from Aston Martin, Grupo Antolin and Polytec, supporting the view that there is still a strong commitment to car production in the UK post-Brexit.

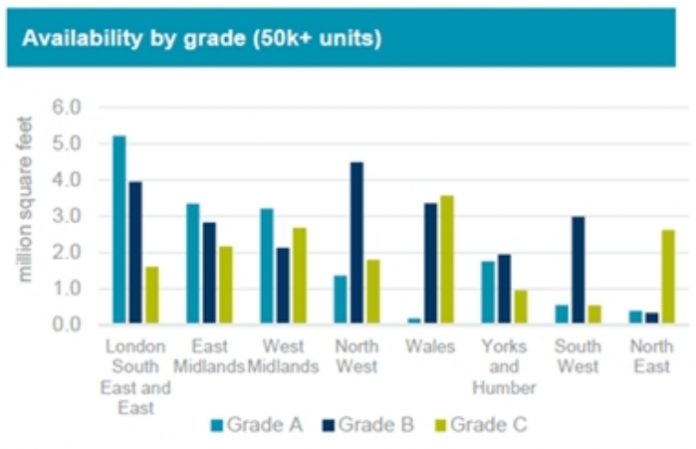

In terms of supply, Class A space increased by 8% or 16 million square feet compared to a year ago, with the bulk of supply coming from London/South East/East (33%) and the Midlands (41%). By contrast, the availability of prime space remains constrained in the North East, South West and Wales.

The growing imbalance between poor supply and strong demand has put upward pressure on rental values across the UK, most significantly in Wales where rents jumped up 20%. However, Cushman & Wakefield forecasts rental rates to grow at a much more moderate pace over the short term.

Overall, the outlook remains positive despite the shaky economic forecast and Brexit uncertainty, and investor appetite for UK logistics property remains strong. Investment in the first nine months of 2017 is estimated at just under £6 billion, an increase on the £5.2 billion invested last year. Prime yields have remained relatively unchanged since Q2, ranging from 4.3% in London to 6.3% in Glasgow, however Cushman & Wakefield predicts further compression in London and the South East over the coming months, while yields are expected to stabilise elsewhere.

David Binks, Head of UK Logistics and Industrial at Cushman & Wakefield, commented: “In the short term, a weaker sterling is bolstering exports for goods and services, particularly in the manufacturing sector which is shaping up to be a significant contributor to take-up this year. With an emphasis from the Chancellor to increase future UK R&D activity, we can expect this trend to continue in the long term.

“Overall the outlook looks positive despite the Brexit uncertainty. The next policy decisions will be watched closely by the industry across the board, especially as a hard Brexit could significantly hamper manufacturing and eCommerce supply chain efficiencies. However, for the time being it is clear that investors still view logistics as a highly-desirable investment, and we are seeing many act with a longer-term view in mind, attracted to the resiliency and structural drivers to the investment.

“We still expect the year end forecast to be in line with long-term averages, due to significant deals expect to be announced in the near future.”