Strong economic growth and £46 billion of corporate investment since 2012 has shaped Cambridge into a successful and world leading bioscience and research centre. However, new research from Savills suggests that with increasing affordability pressures on residential and commercial markets, the right space must be delivered to enable the city to remain competitive on a global stage.

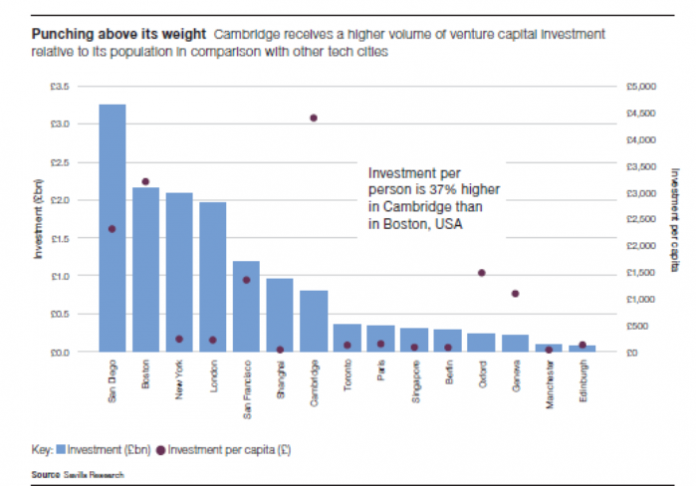

Cambridge’s ability to attract multinational office and lab occupiers has allowed it to compete with global cities as a biosciences and pharmaceutical hub. Whilst the city has seen its fair share of larger corporate transactions within the private equity and Mergers and Acquisitions (M&A) markets, amounting to £46 billion since the beginning of 2012, it is the volume of recent venture capital (VC) investment, which is more reflective of the smaller start-up community, that has indicated the significant latent demand in the commercial property market.

Dividing VC deal volumes by the relative size of the city’s population, Savills has calculated that Cambridge has attracted up to 38% more investment per head than its nearest global competitor, Boston. Nearly a third of a billion pounds of VC investment was invested in Cambridge during 2016 and, as of mid 2017, the figure for the year already stands at circa £270 million. More than 84% is within the pharmaceutical, biotechnology and software sectors, which ultimately supports the need for further development of start-up, grow-on and laboratory space.

This growing momentum has seen average annual take-up in Cambridge reach 620,000 sq ft (57,600 sq m) in the past three years, a 59% increase over the ten year average, which has left the market with only 1.3 years of available supply. With an additional 2,200 office based jobs already forecast over the next five years, Savills anticipates that the city would require an additional 220,000 sq ft (20,438 sq m) of net additional office space.

Consequently, Savills has seen further upward pressure on top office rents. These now stand above all other UK cities outside of London at £37 per sq ft (£398 per sq m). The city has seen top rents rise by as much as £12 per sq ft (£129 per sq m) since 2009, twice that of its next UK competitor, Edinburgh, over this period. Cambridge is likely to see even further rental growth going forward, driven by the unprecedented levels of take-up and an ongoing shortage of speculative office development.

Despite this, global occupiers are likely to be more concerned with wage costs than commercial property costs. Although average weekly earnings in Cambridge now stand at 13.4% above the UK average, the city still remains competitive on the global stage. Accounting for exchange rates, Savills notes that the average salary for a software developer in Cambridge is 32% below the equivalent role in Chicago, whilst in the bioscience sector, an average scientist salary is 40% below that of Cambridge in Boston, USA.

Rob Sadler, head of office at Savills Cambridge, comments: “Cambridge is home to some of the biggest global occupiers including Amazon, Microsoft and Apple and continues to attract businesses from start-ups to multinational firms. Whilst 2.3 million sq ft of office/laboratory space is set to be delivered over the next three years, only 385,000 sq ft of this is speculative. Without sufficient delivery of space, business growth will be constrained, which could see occupiers opt for rival locations both in the UK and across the globe. As we have seen in Boston, USA, life science companies are beginning to adopt densification and more efficient laboratory space including down-sized relocations. It is important, therefore for Cambridge to offer a wide mix and choice of property in order to remain competitive.”

With such high levels of employment growth comes significant pressure on housing. Savills research shows that house prices in Cambridge have grown by as much as 55% in the last five years, out-performing the average rate of growth in England and Wales of 29%. As a result, affordability constraints are limiting the number of people who can actually buy a property in Cambridge. Median house prices are now 13.5 times more than median earnings, one of the highest affordability ratios in the UK. In terms of value per sq ft, Cambridge behaves more like London than the rest of the East of England. For instance, central Cambridge, at £630 per sq ft, is achieving equivalent values to London zone two locations, such as Brixton.

With no obvious trigger for a correction in prices, Savills believes that there is a case for expanding the 40% Help to Buy Equity Loan scheme, currently only available in London, to Cambridge.

David Henry, head of planning at Savills Cambridge comments: “There is a big push to deliver more homes in and around Cambridge. However, much of that growth is spread well beyond the city itself. It can only be successfully delivered if it is supported by a well-planned, timely and integrated network of new infrastructure, linking the city with its hinterland. A variety of solutions are being investigated, including rail and road upgrades, and even an underground shuttle network. What’s clear, is that finding a solution is essential to continuing Cambridge’s growth. Central and Local Government, including the new Combined Authority, have a crucial role to play in ensuring that this much needed infrastructure is delivered so that the city can continue to compete efficiently and effectively on the world stage.”