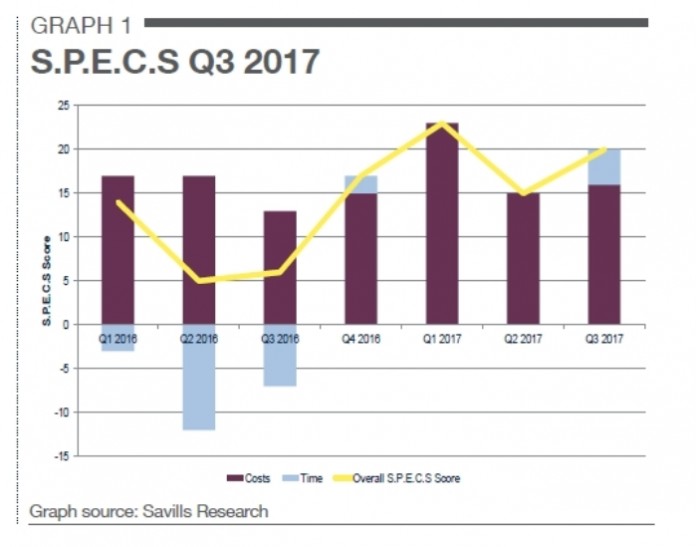

According to the latest Savills Programme and Cost Sentiment Survey* (S.P.E.C.S), timescales for the delivery of new build and refurbishment projects has increased for the first time this year in Q3 2017, whilst costs have generally stabilised or are increasing at a slower rate across most sectors.

The overall S.P.E.C.S score for the third quarter is 20, the second highest since the survey’s inception (a score above zero demonstrates that costs and timescales are generally rising, whereas a score below zero indicates a fall)**. Savills notes that delivery for commercial projects has been delayed by longer lead in times for certain materials, notably steel, as demand and availability continues to squeeze suppliers. Whilst residential property has been hampered by planning delays that have had a significant impact on timescales, especially on larger unit schemes.

Simon Collett, head of building & project consultancy at Savills, comments: “With our S.P.E.C.S indicators demonstrating that project costs and timescales are stabilising or showing a slower rate of increase developers may look to take advantage of an expected slowing of order books into 2018 by timing the release of project tenders.”

Savills research shows that a general softening of construction costs in the residential market can be attributed to steadying in the devaluation of sterling and contractors reacting to a reduction in volume of new orders. These have started to reduce due to the continuing uncertainty caused by Brexit and in turn this is likely to have an impact on tender prices, which will bring a potential squeeze on future margins.

Despite this, the prime refurbishment market is still currently experiencing significant activity, however Savills are starting to see an increase in enquiries from architects, consultants and contractors keen to fill their order books into next year and beyond. This is in contrast to the new-build housing market, where government incentives for first time buyers continue to provide market opportunities for house builders in the medium term, even as the higher end of the new-build market slows.

Material costs have recently become more of a major constraint for house builders. Results of this year’s House Builders Federation (HBF) survey showed that material costs are considered the second largest constraint with 33% considering it a major problem. However, the largest house builders should have more control over their costs as they are able to secure their supply chain in advance. Nationally, the major house builders (those delivering more than 2,000 homes per year) have led the increase in delivery of new homes, accounting for 77% of the market according to the National House Building Council (NHBC).

Jim Wickens, director in the building & project consultancy team at Savills, adds: “Whilst large house builders will welcome a softening in construction cost inflation at a time when demand is still high, future fluctuations in material costs and labour availability have the potential to be a constraint on the amount of stock that can be delivered to the market.”

*The survey is based on sentiment recorded by Savills specialist project managers

** The survey, which is based on 48 separate indicators on asset type and geography, tracks sentiment regarding the cost of construction, costs of fit-out and associated time scales for all grades and geographies of commercial and residential real estate across the UK.