Over the next decade European office buildings face an increased risk of value depreciation and obsolescence as structural change in three factors will combine to accelerate risk according, to the the Jones Lang LaSalle Offices 2020 research programme.

The rate of increase of office obsolescence, where the building is no longer desirable or fit for use, will accelerate due to increasing sustainability legislation, advancing workplace technology and evolving employer requirements.

As a result, substantial amounts of office stock will depreciate in value and be converted to alternative uses. For example, in Amsterdam, take-up of office space over 1,000 sq m totalled 160,000 sq m in 2011, whereas over 93,000 sq m of office space was allocated for uses such as hotels and residential. In Birmingham, take-up over 1,000 sq m totalled 31,100 sq m in 2011. This compares with 50,000 sq m which was allocated for alternative uses. This trend will intensify as legislation and technology continue to evolve.

Bill Page, Head of EMEA Offices Research at Jones Lang LaSalle said: “The majority of European office buildings are old. In Germany for example, 59% of non-domestic building stock dates from between the 1950s and 1990s. In the UK, 22% of commercial building stock dates before 1960, whilst in Paris, two-thirds of office stock is over 20 years old. Old buildings will require even more investment and upkeep to ensure they are fit for purpose. This comes with greater risk.”

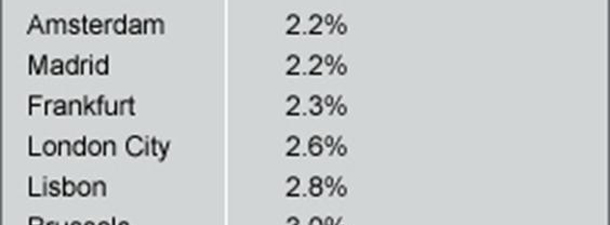

On top of high volumes of adaption for alternative uses, current low rates of replacement of offices in Western Europe, of between 1% and 3%, mean that as stock continues to age, greater strain is placed on investors and occupiers to future proof current assets and safeguard rental income, reduce voids and attract companies willing to take space in the building. This is even more challenging in an environment of limited capital expenditure and product that will essentially be controlled by banks for some time yet.

Benoît du Passage, Managing Director – France and Southern Europe, Jones Lang LaSalle and executive sponsor of the client research project commented: “Whilst depreciation and obsolescence are not new for real estate, they impact offices more than any other commercial sector. Staying ahead of the game is a perennial issue. In France, anecdotal evidence suggests that investors are already pricing in the cost of upgrading buildings to the standards required by Grenelle II, the environmental laws. This will impact property valuations, especially secondary product that may require more substantial financial investment.”

Added Bill Page: “Office buildings are complex development projects that can take many years to move from architect’s vision to finished built product. But the industry and demands of corporate occupiers are evolving at a quicker pace. Companies want flexible buildings that meet evolving sustainability and technology standards, employees want a pleasant work environment. Buildings that fall short of the legal requirements and are unsuitable will either be allocated for other use or, in extreme circumstances demolished.”