Research by property experts JLL, and Tech City UK, suggests the digital tech sector will be the fastest-growing sector in Greater Birmingham’s economy over the next five years.

The analysis looked at eight areas in England, Wales and Scotland where significant digital clusters have come forward; identifying current and emerging property trends affecting the tech sector, and assessing if conditions favour landlords or tenants.

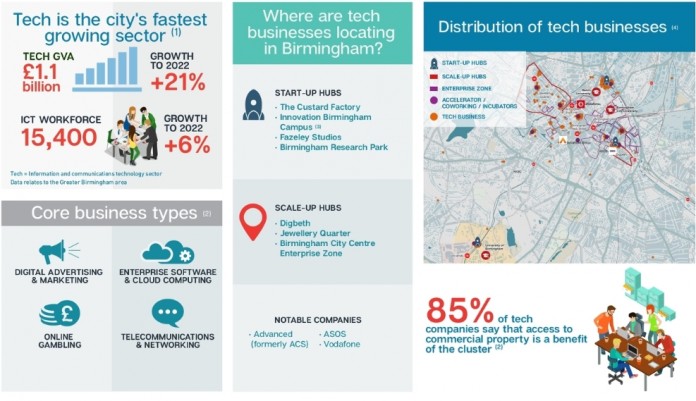

“We expect Greater Birmingham’s tech sector to increase its gross-value added (GVA) contribution to the economy by 21% to £1.1 billion by 2022, and the tech workforce to grow by 6% to 15,400,” says JLL’s Birmingham-based director – national office agency, Kelvin Craddock.

The research highlights Birmingham Research Park, Fazeley Studios, the Innovation Birmingham Campus and the Custard Factory as tech start-up hubs.

“It’s intriguing that the Custard Factory was the original catalyst for the Digbeth cluster, and is still the largest hub of digital and creative talent outside London,” says Craddock. “Its continued presence has also helped make Digbeth a flourishing location for new ventures.

“In other cities and in line with the global rise of the tech industry, we are starting to see startup companies looking to upgrade and move to more prime office space.

“In Birmingham we’ve seen companies such as Advanced relocate to the city, creating 400 jobs, with other occupiers currently seeking space in the city, adding to further inward investment. The talent pool available is certainly encouraging companies from outside of the city and particularly London, to consider moving to Birmingham.

Craddock adds: “As city we can’t afford to miss out. We used a traffic light system to indicate to occupiers and landlords what the current conditions are. At present we see the Greater Birmingham market as fairly evenly balanced for vacant office space – either Grade A or Grade B. However, there are signs that space will begin to contract in 2018.

“Prime costs are rising, the current Grade A rent is £32 psf pa, and we expect that to rise by an average 3.1% during 2017, so we have a red light on rents. Fortunately, there is a number of quality office schemes coming forward, so the ‘pipeline’ light is on green at the moment.”

However, Craddock believes that whilst there is sufficient quality space at the moment to accommodate rapidly expanding tech ventures, companies need to start planning their moves now to take advantage.

“We also need think about as an industry and city the type of space we bring forward, with co-working and more exciting, flexible space being a key draw for the tech sector.

“We’ve started to see more examples of this, with buildings such as The Assay Office in the Jewellery Quarter creating exciting working environments that encourage companies to interact. Whilst areas such as the Jewellery Quarter and Digbeth offer scale-up hubs, to really attract the big tech giants we need to replicate this type of the space and working environment in areas such as the city’s core, within buildings that offer the resilience and profile demanded by larger tech firms”