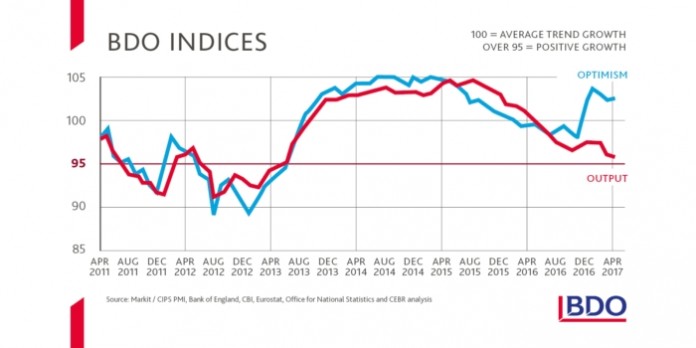

UK business output has fallen to a four-year low, according to the latest Business Trends Report by accountants and business advisers BDO LLP.

The new report reveals that BDO’s Output Index – which indicates how businesses expect their order books to develop over the next three months – has fallen to 95.6 in April from 95.9 in March, the lowest level in four years. It is now well below the long-term growth trend of 100 and is only just above the point of contraction, below 95.0.

The slowing services sector, which makes up the majority of the UK economy, is primarily responsible for the gloomy output figures. BDO’s Output Index for the services sector has fallen to 95.3 from 95.7 the previous month. In April last year, the Services Output Index was sitting at 100.4, which is above the long-term growth trend. While the sector’s growth was shrinking before the vote to leave the European Union, its waning performance has been more pronounced since the Brexit decision. Consumer-focused services – such as retail – have been the hardest hit by the recent squeeze on household disposable incomes.

The Manufacturing Output Index fell marginally from 97.2 to 97.1 in April but is well above the 2016 average of 95.2. The sector has been buoyed in the last few months by the post-EU referendum fall in the value of sterling, making products more price-competitive, and also the pick-up in the global economy.

Despite slow growth in output, UK businesses continue to be optimistic about the future. BDO’s Optimism Index – which indicates how firms expect their order books to develop in the coming six months – has risen to 102.5 from 102.2 in March. This is likely due to the slight strengthening of the pound following the announcement of the general election and a steadying of the growth in inflation. BDO’s Inflation Index fell from 105.2 to 104.7 in April.

The optimism of UK manufacturers is especially high following the growth of the sector in Q1 2017. BDO’s Manufacturing Optimism Index rose from 110.6 in March to 112.2 in April and is now at its highest since January 2015. This is well above the long-term growth rate and indicates that manufacturers are expecting significant growth in Q1 2017 despite the sector contracting only six months ago.

Commenting on the findings, Richard Rose, Midlands Tax Partner, BDO LLP, said:

“There appears to be growing disconnect between what businesses are experiencing now and how they expect their order books to develop in the coming six months. Current output levels are very close to a zero-growth level, yet UK business people are strongly optimistic. This would suggest that we could be in line for a significant growth surge in early 2018.

“We haven’t seen anything quite like this since 2009. Then, UK businesses were so used to continuous economic growth that they couldn’t quite believe it when the good times didn’t immediately return. Something similar seems to be happening at the moment. UK businesses seem to be excited and upbeat about a post Brexit ‘global Britain’. This is despite their current experience of very subdued economic conditions.

“Optimism is often a good precursor for growth, as confident hiring and investment decisions are the key determinants of economic success. Nevertheless, realism suggests that current optimism levels are probably pretty fragile. The government should not be afraid to do whatever it can to support growth if and when it is required.”