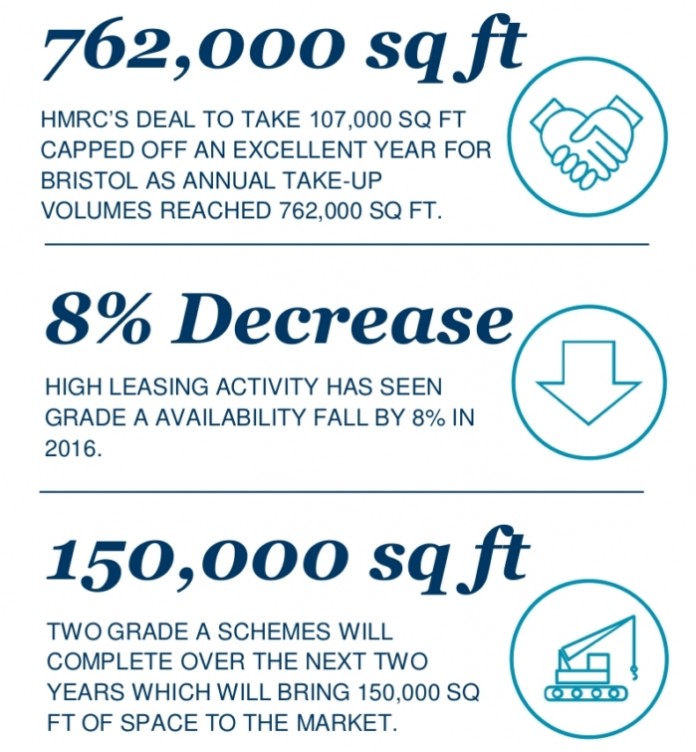

Cushman & Wakefield has released its Q4 2016 ‘Snapshot’ report on the Bristol office market – showing that total Bristol office take-up in 2016 reached 762,000 sq ft.

Occupier View

Andy Heath, Partner, Office agency at Cushman & Wakefield in Bristol comments:

“The high level of leasing activity witnessed in 2016 should continue this year, leaving very little grade A and good quality grade B space remaining, and as a result, prime rents should finally break the £30 per sq ft barrier.

With funding of speculative development so difficult, Bristol will turn into a pre-letting market, some signs of which are already happening with the recent deal to HMRC and the transaction under offer to ARUP as well as other live enquiries. The future is very bright and bold for Bristol but it must make the most of this opportunity.…”

Investment View

Nick Allan, Partner, Investment agency at Cushman & Wakefield in Bristol comments:

“Trading volumes during 2016 dropped markedly compared with 2015 for Greater Bristol, entirely led by stock availability than investor demand. In fact, investor appetite for prime and secondary assets within central Bristol remained very strong throughout 2016 and continues to be into 2017. The challenge has been the availability of investment stock which fits investor’s requirements.

We anticipate an increase in trading during 2017 as some investors have become more confident in post EU Referendum pricing than they were immediately after the vote.”