More than a third of UK commercial property investment deals that were offered to the market prior to the country voting on 23 June to leave the EU have now completed – with a combined transaction volume of £4.6bn, according to Cushman & Wakefield.

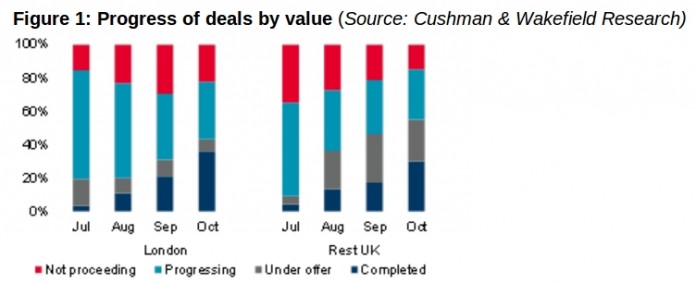

A further 15% of deals, worth £2bn, are currently under offer – and the proportion of deals not proceeding has reduced both in London and regionally.

A greater share of deals have completed in London than the rest of the UK, at 36% compared to 30%. Positively, for the rest of the UK the figure jumps to 55% compared to London’s 44% when under offer deals are included. This reflects a higher share of smaller lots as well as greater variety of asset types.

Nigel Almond, Head of EMEA Capital Markets Research, said: “Four months on from the vote and the majority of deals that were live at the time are still yet to complete, underscoring the fact that transactions are taking longer to progress. The next few weeks will provide a clear market barometer with over £1bn of assets expected to go to best bids.

“More positively, several deals which were pulled in the immediate aftermath of the vote have returned to the market with adjustments to pricing. The past month has also seen plenty of new investments offered to the market.”

Among deals which have completed, both private investors and property companies have been active across London, with a broadly equal share of capital from both domestic and overseas sources. In fact, 80% of overseas investment has been in London.

Outside London, domestic funds have been particularly active which highlights that, despite the attention it garnered, the open ended fund crisis was limited to a small number of funds. Local authorities have also been active, benefiting from cheap finance available from the Public Works Loan Board.

There is a clear polarisation in the market in the level of progress by lot size. To date 68% of assets under £20m have completed in share contrasts to just 17% for over £100m. There are also far fewer assets under £20m that have failed to progress.

Jason Winfield, Head of Investment Agency, UK & Ireland, added: “Initial concern of a collapse in prices has not materialised. The weighted average fall from offer price to complete price is just 2.8% with little variation between London and the rest of the UK. The variation is clearer by lot size. The weighted average discount on lots under £50m is just 1.7%, rising to 3.9% on those over £50m. There is, however, a far narrower spread on pricing for larger lots which indicates a much greater degree of clarity on pricing in this price bracket.”