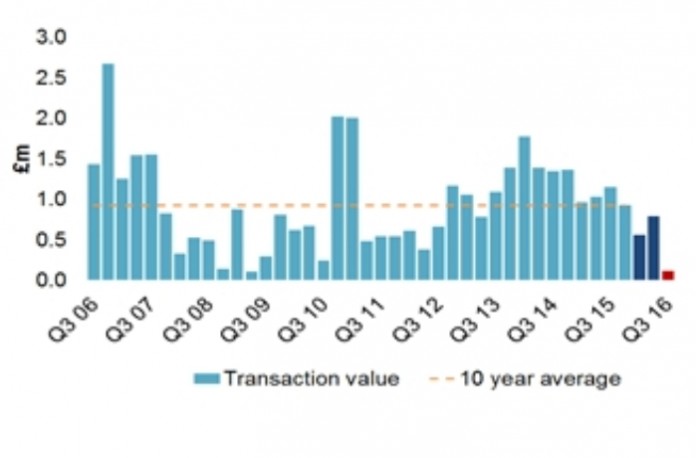

The UK’s decision to quit the EU has had a dramatic effect on shopping centre investment decisions, with transactions totalling just £118m. However, with retail funds having since re-opened, sentiment is improving and transaction volumes could reach 2012 levels by the year end.

Consumer confidence has also returned to pre-Brexit levels with positive sales growth in the two months following the EU referendum. However, with inflation forecast to rise in 2017 there are industry concerns that retail sales volumes will be hit and attempts by retailers to absorb price rises could impact profit margins.

The three large investment transactions in Q3 2016 were: Manor Walks in Cramlington, sold by Hammerson to Arch Commercial Enterprise (Northumberland County Council) for £78m (Yield 7%); Lisnagelvin Shopping Centre in Londonderry, sold by British Land to Cordatus for £17.2m (Yield 6.9%) and the Red Rose Centre in Sutton Coldfield, sold by LaSalle IM to Birmingham City Council for £10.4m (Yield 7.4%)

Barry O’Donnell, Head of UK Shopping Centre Investment for Cushman & Wakefield, said: “The political and financial volatility following the EU referendum resulted in extremely low shopping centre investment volumes in the last quarter. However, investor confidence is improving with renewed overseas interest coupled with weak sterling and a softening in yields bridging what was a marked gap in seller and buyer expectations during the summer.

“There are a couple of chunky deals under offer which will, in my view deliver a much healthier transaction volume than the paltry Q3.”

Jonathan Rumsey, Cushman & Wakefield Head of UK Retail Market Analysis, said: “Despite immediate falls following the referendum result, consumer confidence has returned to pre-Brexit levels and official retail sales data remains strong. We do however expect increased supply chain costs to filter through to shoppers next year which could affect retail sales growth.

“It’s also notable how reliant sales have been on the public sector. Councils have purchased seven schemes so far this year totalling £271m. That represents 18 per cent of total investment spend and 23% of the total number of schemes.”