The willingness to lend against UK commercial property will not be impacted by the result of the UK’s decision to leave the European Union, according to the latest instalment of the Cushman & Wakefield European Lending Trends report.

The fourth edition of the Cushman & Wakefield report is based on survey responses of 50 major, active lenders from across Europe and considers views on recent activity as well as trends expected over the next six months.

The latest results show that the overwhelming majority of respondents (95%) said the fallout from Brexit will not stop their lending in the UK, although the overall volume of new loan originations was down across Europe in the past six months. This was in part caused by caution regarding Brexit but in addition was due to slower deal activity in the first half of 2016 across the continent compared to the second half of last year.

Looking ahead, the report states that market conditions remain encouraging across Europe with a positive balance of lenders reporting an increase in originations and refinancing for the coming six months. Some 80% of lenders expect loan originations to be the same, or increasing, compared with the past six months, rising to over 90% for refinancing.

The survey results also revealed that the majority of lenders are providing senior loans, with whole loans and stretch senior loans the next most common reflecting the preference in the market for a single provider.

Edward Daubeney, Director EMEA Structured Finance at Cushman & Wakefield, said: “Our survey shows that Brexit is having little impact on market sentiment from a lending perspective and the fundamentals remain encouraging. The trend towards lending by geography has also not changed significantly over the past six months, albeit the UK’s share has softened marginally in the wake of the vote result. Elsewhere, we see more lending in Central and Eastern Europe and Italy, mostly at the expense of the Nordic countries.

“Lenders remain focussed on standing investments in both top tier and second tier markets. There remains a clear focus on good quality, well-let assets with lenders more focussed on increasing lending on pre-let developments in second tier cities over secondary assets. Where development finance is available, it’s for pre-let developments with experienced developers. Speculative development finance is almost non-existent since the UK’s vote to leave the EU.”

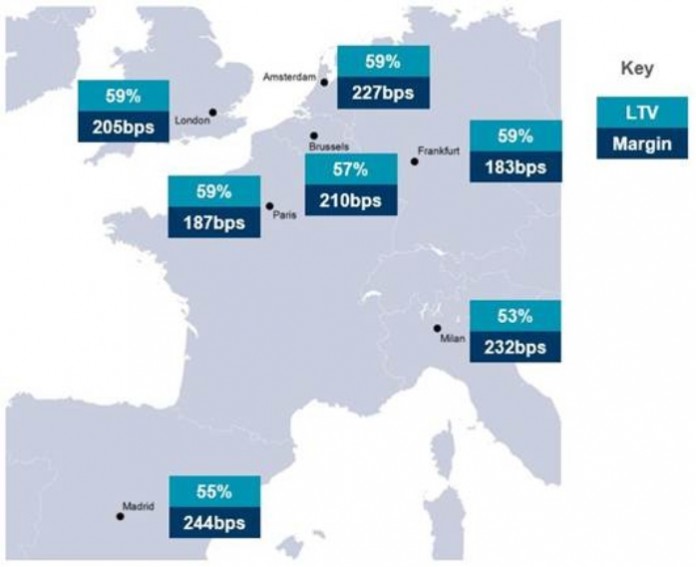

The report shows that the average loan-to-value (LTVs) ratio at the all-property level has fallen since the last survey in January and is now below 60% in all markets. LTVs now range from 59% in Amsterdam, Frankfurt, London and Paris to 53% in Milan. This underscores restraint in the market with no sign of movement back to the trends in 2006/07.

Nigel Almond, Cushman & Wakefield’s Head of EMEA Capital Markets Research, who compiled the survey, added: “Since our last report, we are noticing a rise in loan margins across the major European centres. At the same time the five-year European swap rate has fallen by close to the same amount which effectively leaves the overall cost of borrowing at similar levels. The UK is no different to the continent with margins in London edging out since our last survey, effectively neutralising the approximate same drop in UK swaps.

“We are seeing commercial banks and institutions typically lending in the 50-60% loan-to-value bracket, with debt funds most willing to lend up to 70-80%. Similarly, margins are typically lower from commercial banks and institutions relative to debt funds. These trends reflect the willingness of debt funds to operate further up the risk curve.”