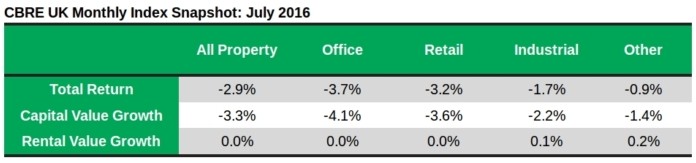

Rental values across the UK’s commercial property market were steady in July, while capital values fell by -3.3%, according to the latest CBRE Monthly Index.

The fall in capital values was widely expected and pulled year-on-year growth down to 0.4%. Heightened economic uncertainty, especially for financial services firms, hit offices in the City of London, shrinking capital values by -6.1%. But overall, capital value decline in the Central London office market was the same as for offices across the UK, at -4.1%.

Capital values in the retail sector fell -3.6%, but the industrial property segment was more insulated with a lower fall of -2.2% for the month, reflecting continued strong demand but weak supply.

Rental value growth dipped to zero in July from 0.2% the month before, holding steady across office and retail sectors (including Central London offices), and growing by 0.1% in the industrial sector. Downward pressure on rental values came from standard shops within the retail sector, which fell by -0.3% overall, and -0.6% outside the South East.

Miles Gibson, Head of Research at CBRE UK, said: “Capital value growth was always expected to falter at some point during 2016, as global economic uncertainty cast doubt on the likelihood of the strong growth seen in previous years persisting for much longer. The Brexit vote has now crystallised that expectation, though it is not the only driver of it.

“It’s reassuring to see rental values have held firm in the face of this heightened uncertainty, a positive sign that the UK occupier market remains strong, sustained by record levels of employment, and low borrowing costs.

“It will be some time until we understand the full impact of the Brexit decision, but the Bank of England’s base rate cut and more quantitative easing are likely to be supplemented by a similarly supportive fiscal stance in the autumn.”