Lending margins have risen by 25 bps to roughly 2.4 per cent in Q2 2016, according to CBRE’s latest Debt Prospects MarketView. Lenders have re-priced risk due to uncertainty in the market following the referendum vote in June. CBRE estimates that the consequent reduction in capital growth forecasts has increased the Probability of Default and Estimated Loss on senior LTV originations to 2.2 per cent and 0.3 per cent respectively in Q2 2016, an increase on the previous quarter from 0.5 per cent and 0.1 per cent respectively.

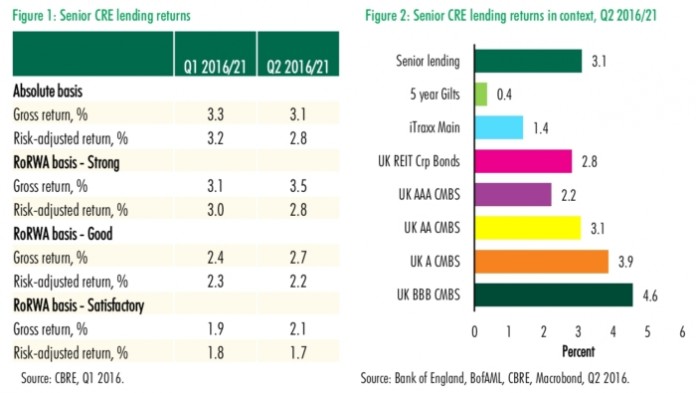

This combined with a fall in swap rates – which has had the beneficial impact of lowering the cost of borrowing – means that CRE lending returns have fallen slightly to 3.1%, on a gross basis, and 2.8% on a risk-adjusted basis. However, with Gilt yields also tumbling, senior CRE debt is now an even more attractive asset class than before the referendum, the premium over Gilts having widened to 2.7 per cent (on a gross basis).

Whilst lending risk increased in Q2, CBRE does not believe it has risen to a concerning level. Despite the prevailing uncertainty, the UK CRE lending market is significantly better placed to withstand a shock than it was during the Global Financial Crisis because there is a more diverse pool of capital, with alternative lenders emerging to re-balance market share.

The fundamental features of the property market and the UK economy are also far better positioned to weather a period of turbulence. CBRE analysis suggests that banks are far more resilient to potential falls in market values; there may be some increase in the level of Risk Weighted Assets but we do not foresee a likelihood of further capital raising to deal with issues related to CRE lending. And even during the Financial Crisis, where owners had much higher levels of debt and a much more constrained credit market, there were far fewer forced sellers than anticipated. Lenders have heeded the lessons of historic periods of uncertainty by reducing LTVs on CRE debt from approaching 80 per cent in 2006/07 to the low-60s in more recent years.

Following the Brexit vote, all types of lender have moved quickly to reassess their existing portfolios in the light of the changed outlook for the commercial real estate market and to understand the new basis on which new lending should now be undertaken. One possibility is that senior LTVs may fall back further as lenders attempt to reduce default risk. According to CBRE’s debt pricing model, by cutting senior LTV from 65 per cent to 55 per cent, the Probability of Default for Q2 2016 lending would fall by approximately two thirds, broadly returning it to levels seen in Q1 2016.

Dominic Smith, Head of Real Estate Debt Analytics, CBRE, commented:

“Our analysis allows banks to forecast their lending returns and plan accordingly, particularly following a political event such as the EU referendum. The uncertainty that has arisen as a result of the decision to leave the EU has caused some measures of lending risk to increase. However, arguably neither borrowers nor lenders are any worse off than before. Lenders are carefully trading off LTV against margin to manage their risk levels, and will monitor existing and new lending for any potential signs of stress. We expect further changes in market sentiment and pricing to come in the second half of the year, but we also believe that with CRE debt offering excellent risk-adjusted returns against other forms of fixed income, lenders brave enough to move now could take advantage of a significant pricing opportunity.”

Steve Williamson, Head of Debt and Structured Finance at CBRE, added:

“Speaking with lenders, the Brexit vote and the shortage of transactional data over the past 6-8 weeks has caused uncertainty around the outlook for certain sectors of the real estate market. As a result, lenders are tending to err on the side of caution (such as reducing LTV’s and/or increasing amortisation). While margins have moved out slightly, as underlying long term rates have tightened, the overall “total” costs of finance for a sponsor have barely varied. The good news is that there is still plenty of finance available and a competitive market still exists for a good sponsor, seeking sensible finance for good quality real estate.”