The stamp duty tax changes announced in the Budget reduced overall commercial property capital values in the UK, according to the latest CBRE Monthly Index, but rental values grew more in March than in January and February combined.

After three years of continuous growth for the sector, capital values fell by 0.4% in March, as the new tax bands increased acquisition costs for properties valued at over £1.05 million. Rising acquisition costs affected capital values, which were growing at a rate of 0.2% in February before the new stamp duty charges were announced. The changes have helped those with smaller properties, offering a net benefit to sites valued at under £1.05 million but came as a blow to investors in large commercial properties. The impact on overall capital values, which have grown by 28.4% over the past three years, is a one-off.

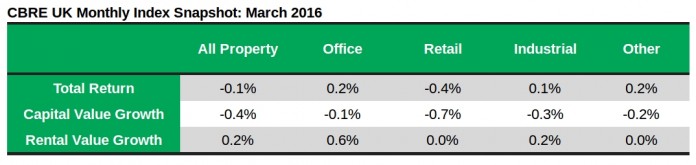

Some areas and sectors have been harder hit than others. Offices in the City of London experienced the greatest month on month fall in capital values, with February’s strong monthly growth of 1.7% falling to a 0.2% contraction in March. Overall, offices saw capital value growth slow from 0.6% to -0.1% over the same period. In the retail sector values fell by 0.7%.

While the reforms have had a one-off impact on capital values, rental values climbed across UK commercial property by 0.2% in March (more than January and February combined). This rental value growth was driven by strength in the office market where rental values rose by 0.6%, led by 0.9% in Central London offices. Retail rents were flat in March, bouncing back from a contraction of 0.3% the month before.

The stamp duty changes did contribute to a monthly fall in total returns, which shrank by 0.1% in March having grown by 11.8% in the past 12 months. Yields remained flat at 4.8%, down from 5.1% in March 2015.

Miles Gibson, Head of UK Research at CBRE said: “The stamp duty changes have been a tax grab for the Chancellor to the tune of £500m per year, a notable 15% increase in the tax take. While capital values inevitably took a one-off hit in March, rental values held up, underpinned by strong demand from occupiers.”

“For all the criticism of the new tax rules, commercial property continues to exhibit flat yields on balance, and total returns are expected to recover once the changes to the cost of buying a property have been factored in to valuations.”