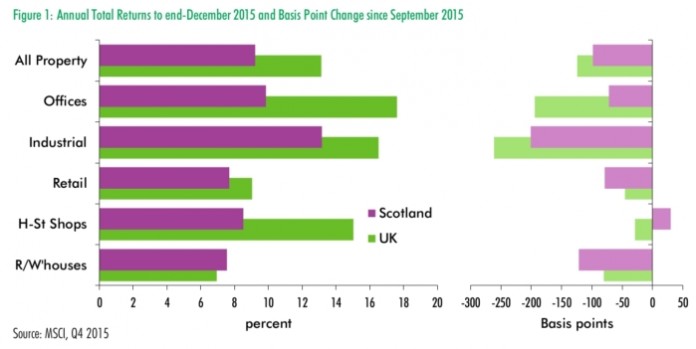

Leading property consultant CBRE has released the findings from its Scotland Property Quarterly report, with statistics showing Scottish commercial real estate produced a total return of 1.9% in the fourth quarter of 2015, leading to an overall annual return, across all asset types, of 9.2%.

As expected, the best performing sector of 2015 was industrials, with a return of 2.4% in the final quarter of the year, outperforming offices and retail for the ninth consecutive quarter in a row. However, for every quarter of 2015 the size of industrials’ total returns has edged lower, starting the year at 4.2% in Q1. By the fourth a final quarter, the sector’s returns were almost matched by offices which came in at 2.3%, an increase of 0.2% on Q3.

In fact, across the full year offices almost saw double digit returns at 9.9%. However, there is no doubt the sector was affected by the downturn in the Aberdeen market.

Of all the sectors, industrials also saw a superior rental growth, with Estimate Rental Values (ERVs) expanding by 0.5% during Q4 and 3.2% for the year as a whole.

Retail returns appear to have lost pace when compared with Q3, with a Q4 total return of 1.7% which is down from 2.4% in the previous quarter. Across 2015, retail was also the weakest performer with a total annual return of 7.7% compared to the 10.6% posted in 2014.

However, while the pace of rental value growth for industrials and offices has slowed, retail has seen rental growth almost flatline at 0.2% per quarter which provided a positive, albeit modest, contribution to overall capital growth of 3.3% across the year.

At a city level, the relative under performance of the Aberdeen office market has clearly pulled the overall Scottish All Property Total Return lower. At the end of last year, a total of six city sectors were outperforming the All Property Return on 9.2% with Edinburgh industrials posting 18.3%, down from 21.5% in Q3. This is followed by Edinburgh offices, with a total return of 14.8%, unchanged from Q3.

Meanwhile, Glasgow offices remain the one city sector which is seeing returns improve quarter-on-quarter, ending the year at 13.2%, up from 12.7% in Q3.

Investment activity during 2015 wasn’t quite up to the pace of 2014. By the end of the year a total of £2.17bn of investment has been made across Scotland, which was around £900m less than the previous year. The only sector which came close to matching the volumes of 2014 was offices, which saw almost £800m being transacted. The largest deal came at the tail end of the year with the sale and leaseback of Standard Life’s HQ on Lothian Road, Edinburgh.

The key retail deal of the year was the purchase of the Eastgate Centre in Inverness for £116m by Harbert and Scoop Asset Management, with the sector as a whole seeing its transactions totaling £667m in 2015.

The most notable change between 2014 and 2015 was investment into industrial property, with only £143m spent despite the sector’s superior performance, down from £414m the previous year.

Aileen Knox, senior director at CBRE, said: “In the main, the Scotland Property Quarterly report has shown a fairly varied performance for Scottish real estate across 2015, with capital growth gathering positive results at 3.3% for the year and Glasgow offices showing quarter-on-quarter increase in returns, while the slowdown of the Aberdeen market influenced the final figures and pulled overall offices returns to just shy of 10%. Industrials remain the strongest overall sector, despite steadily decreasing in returns since the start of 2015, and the Glasgow and Edinburgh markets are clearly leading the way for investment activity.”