The proportion of international investment in Scottish commercial property increased dramatically in 2015 despite overall investment volumes falling from £3.2bn in 2014 to £2.2bn in 2015, according to research produced by JLL.

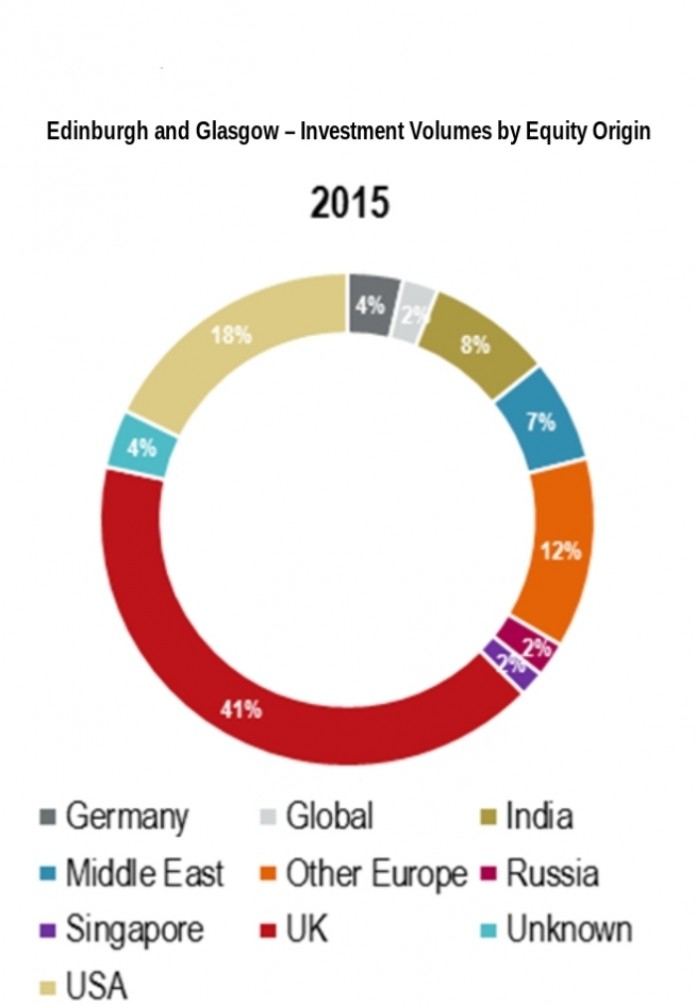

Specifically, in 2015, £1.3bn (59%) of commercial property investment into the key markets of Edinburgh and Glasgow came from overseas, compared with £1.6bn (49%) in 2014.

During the same period, the proportion of UK money invested in Edinburgh and Glasgow commercial property dropped from 51% (£1.6bn) in 2014 to 41% (£900m).

The higher proportion of international vs domestic investment in Scotland is not reflected in any other UK region, outside of Central London, where the percentage of domestic investment was 35% in 2015.

In 2015, 57% of all investment in UK commercial property came from the UK, and 43% came from international investors. In the same period, domestic investors made up 82% of all purchases in Manchester, and 97% of all purchases in Leeds.

Key Findings

JLL’s research found that:

· American investment in Scotland spiked in 2015, accounting for 18% (£396m) of all transactions, compared to a 4% share in 2014 (£128m). This is a rise of £268m.

· Compared with 1% (£32m) in 2014, Middle East investors were involved in 7% (£154m) of all Scottish investments in 2015.

· The office sector proved to be increasingly popular accounting for c.55% of volumes – up from 38% in 2014.

Buyer Profile

The changing profile of property investor in Scotland is due to a number of triggers, according to JLL.

UK Institutional caution – setting aside a general easing in weight of money, the continuing uncertain political landscape is causing the Funds to go “Scotland – light”. There is no wholesale selling but Funds are reticent to be over exposed to Scotland in terms of their overall portfolio weightings.

Global movement of Capital – influences such as political instability in the Middle East, Russian economic crisis and Asian market jitters are all adding to the flow of capital coming from these regions/countries trying to find more stable markets such as the UK.

London has become increasingly expensive – hence the larger regional markets in the UK including Edinburgh and Glasgow have looked like offering reasonable value. This is particularly so for more mature/sophisticated investors (e.g. North American Private Equity and German Institutions) who are very au-fait with the regional markets.

Examples of deals that would have traditionally been secured by UK institutions but have gone overseas include 180 St Vincent Street, Glasgow and 125-126 Princes Street Edinburgh – bought by US venture capitalists Northwood Investors and 74-77 Princes Street, Edinburgh – bought by German group GLL.

Chris Macfarlane, Director in Capital Markets said: “As the depth of Fund buyer has thinned, pricing has softened and our key markets are looking like fair value. The vacuum left has been filled by a range of investors (particularly overseas) which is positive.

Looking forward, we see the following themes:

· Until there is more clarity on the political landscape, the UK Institutions will continue to be cautious on Scotland. Politicians – please take note, creating an environment of uncertainty does not help the commercial property market.

· Overseas Private Equity and High Net Worth Investors will continue to be prevalent in the Scottish market.

· Pricing at the prime end will hold firm, sellers of core plus and secondary product will need to price attractively to create any competitive tension.

· Investment agents will be busy trying to re-invent their client base (including chasing some of the more exotic money). More trips abroad perhaps…..”

Simon Merry, Director of Capital markets at JLL said: “2015 was the first year we saw international capital spend more in Manchester than domestic investors with particularly the German and Asian investors dominating the office investment market.”