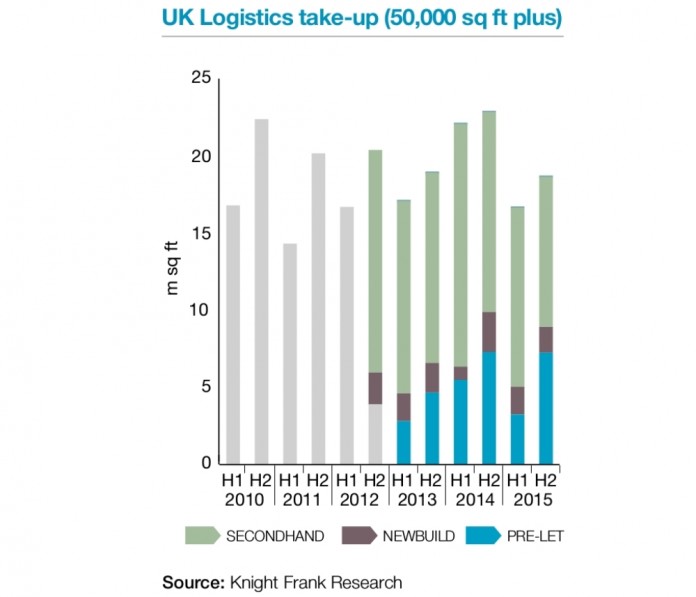

UK Industrial occupier demand strengthened in the last six months of 2015, with a total of 18.8m sq ft of units above 50,000 sq ft acquired for occupation. This is 12% above the level of take-up in H1, and brought total take-up for the whole of 2015 to 35.6m sq ft.

This strengthened demand came from a wide variety of retailing and associated logistic distribution operators, mirroring the recent activity by Amazon who continue to grab headlines as they build their delivery networks around the UK.

Pre-lets accounted for 39% of take-up in the second half of 2015, highlighting the growing confidence in the market and continuing lack of supply. Given this lack of supply and strong rental growth, which now exceeds 5%, more speculative development is expected to come through the development pipeline, particularly in the wider South East

Meanwhile in the UK Industrial Investment market, Property Data figures show that just over £2.7bn of industrial assets changed hands during the second half of 2015, bringing total investment transactions for the whole of 2015 to £5.65bn, on trend with the years prior to 2014.

Yields between prime and secondary assets are still narrow by historic standards, with single-let distribution yields at 4.25% and prime multi-let and secondary estates at 4.75% and 6.75%, respectively.

Charles Binks, Partner, Knight Frank Industrial Agency, commented:

“Expect to see take up remain steady into 2016, with online sales remaining the key driver of demand. 2016 will see the delivery of a number of spec build units throughout the wider South East and Midlands markets, rebalancing the supply/demand dynamic in certain areas.”

Louisa Rickard, Associate, Commercial Research, commented:

“With growing confidence in the market and industrial rental growth now in excess of 5%, the outlook for both the occupier and investment market in 2016 remains positive.”