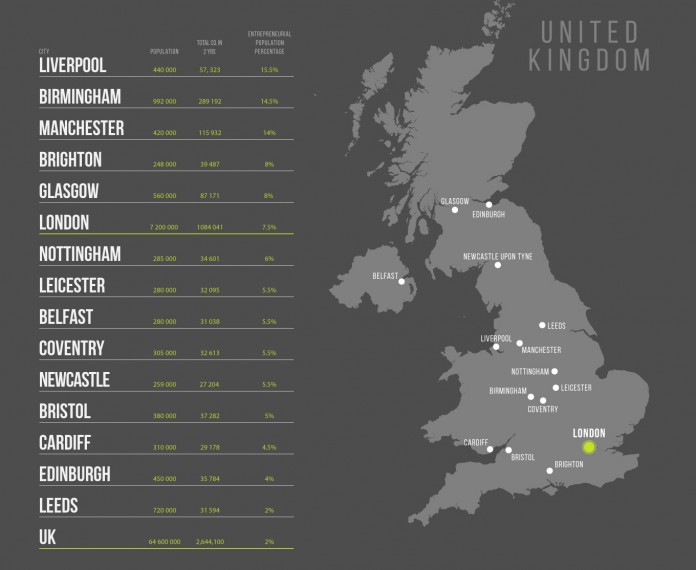

The UK’s largest regional cities, are nearly twice more likely than London to have produced an entrepreneur over the past 24 months, according to research derived from Companies House Data by international office space broker, Instant Offices.

Instant Offices has mapped out the UK’s start-up landscape over the last two years and compared it to the population size of each city, providing a leaderboard of the most entrepreneurial cities in the nation. Now named Europe’s most entrepreneurial country, over 2,644,100 businesses have started in the UK within the last two years alone, according to data gathered from Companies House, with 2015 being a record year for start-up growth.

The research highlights interesting trends with key cities clearly ahead of the UK average and the nation’s capital.

For instance, the population of Liverpool is estimated at 440,000. With 57,323 new companies starting over the past 2 years. This results in an entrepreneurial population percentage of 16%. Birmingham’s entrepreneurial population percentage was 14.5% followed closely by Manchester at 14%.

These numbers are significantly higher than the UK average at 2% and the nation’s capital London, which holds an entrepreneurial population of just 7.5% by comparison. Tim Rodber, CEO of the Instant Group said: “As the largest broker of flexible workspace in the UK we are in a good position to take a market overview, and undoubtedly, we have seen a resurgence in demand from the regions in 2015. Enquiries for flexible workspace in the regions were nearly a quarter up on the previous year and a lot of this demand was driven by one to two desks enquiries, which is indicative of start-ups.”

“The strongest demand for space has come from the large cities outside of London where, proportionately-speaking, Manchester, Birmingham, Liverpool and Edinburgh are outperforming the capital. SMEs are hungry for space in these regions but we are also seeing larger space requirements too, which means that corporates are setting up teams to cater for project work and serve the regional markets.”

“It is also interesting to note that while enquiries for flexible space were up 21 per cent for the UK in total and 39 per cent in the regions, the growth in non-flexible office enquiries was up only 15 per cent, which suggests that many of these firms want space to grow but are not ready to commit to leased offices as yet.”

| City | Population | Total new companies in 2 years | Entrepreneurial Population Percentage |

| Liverpool | 440 000 | 57 323 | 15.5% |

| Birmingham | 992 000 | 289 192 | 14.5% |

| Manchester | 420 000 | 115 932 | 14% |

| Brighton | 248 000 | 39 487 | 8% |

| Glasgow | 560 000 | 87 171 | 8% |

| London | 7 200 000 | 1 084 041 | 7.5% |

| Nottingham | 285 000 | 34 601 | 6% |

| Leicester | 280 000 | 32 095 | 5.5% |

| Belfast | 280 000 | 31 038 | 5.5% |

| Coventry | 305 000 | 32 613 | 5.5% |

| Newcastle | 259 000 | 27 204 | 5.5% |

| Bristol | 380 000 | 37 282 | 5% |

| Cardiff | 310 000 | 29 178 | 4.5% |

| Edinburgh | 450 000 | 35 784 | 4% |

| Leeds | 720 000 | 31 594 | 2% |

| UK | 64 600 000 | 2 644 100 | 2% |