Bilfinger GVA’S Big Nine report reveals Q4 2015 occupier take-up figures in Manchester and Liverpool, highlighting an increase in demand for city centre office space.

The property consultancy’s Big Nine: Quarterly review of the regional office occupier markets analyses regional city centre and out-of-town office activity in the Big Nine cities outside of London.

The Big Nine review shows that both Manchester’s city centre and out-of-town office markets exceeded the five-year quarterly average take-up figures in Q4 of 2015, with Manchester’s annual city centre figures close to record levels at 1.3 million sq ft.

Bilfinger GVA’s Manchester team said the report highlights strong occupier demand levels, with Manchester’s city centre five-year quarterly average the highest of all nine cities outside of London.

In Manchester city centre occupier take up levels continued to rise and in Q4 were at 259,632 sq ft, 3.7% above the five year quarterly average.

While in Liverpool, for the first time in over a decade, office take up in the city centre totalled over 100,000 sq ft for the second consecutive quarter.

The quarterly take up in Liverpool reached 113,216 sq ft – way above the quarterly average of 76,760 sq ft for the city centre over the last five years.

The key letting in Manchester this quarter was 56,000 sq ft to Addleshaw Goddard at One St Peter’s Square, bringing annual city centre take-up close to the record levels of 1.3 million sq ft.

The Q4 figures do not include the 80,000 sq ft Freshfields deal at One New Bailey which will fall into Q1, one of an increasing number of businesses to ‘northshore’. The XYZ building is also now fully let.

Significant deals in Q4 for Liverpool included an 11,100 sq ft letting to Mann Island Finance at No 5 St.Paul’s Square and an 11,800 sq ft deal to Inenco at the Corn Exchange.

In addition, the report highlights Manchester’s out-of-town performance is well above average with 250,553 sq ft let in Q4, which is12.5% above the five year quarterly average. The top out of town deal completed was for the 43,500 sq ft transaction at Edward Street for Stockport Homes.

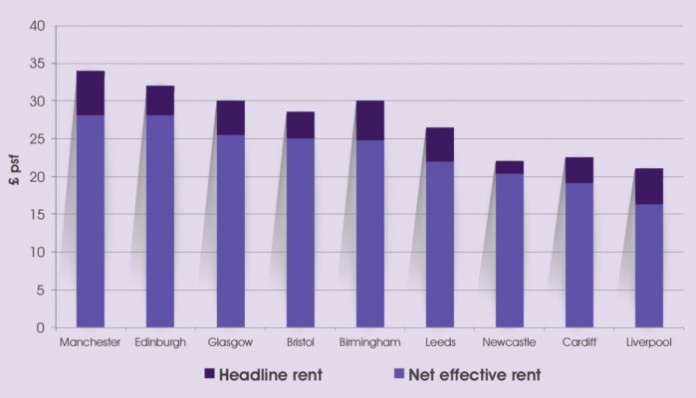

With the supply of grade A space remaining tight, the city centre has continued to demonstrate high levels of rental growth. Once again, for a consecutive quarter, Manchester is achieving the highest rent of the Big Nine cities at £34 a sq ft.

Chris Cheap, Senior Director and Head of Offices at Bilfinger GVA in the North West, said: “Regional occupier office take-up activity is reaching a peak, with Manchester’s annual city centre take-up close to record levels and with the highest five year quarterly average – the city continues to lead the way. The sheer number of transactions in 2015 is testament to the depth of the market place.

“Supply of prime space remains extremely tight across the nine cities with an average just short of a years’ availability based on past take-up rates. This is none more so apparent than in central Manchester where there is just six months supply of built and available prime stock and while there is a healthy development pipeline, occupiers with short time horizons really need to be taking action. ”

Ian Steele, director at Bilfinger GVA Liverpool, said: “It is clear that there has been an increase in demand for office space in Liverpool City Centre which is in line with the economic upturn. However, one of the biggest challenges is the shortage of Grade A stock in Liverpool with less than one year’s supply and the lack of new developments in the pipeline means that occupiers will potentially have limited options for relocation and expansion.

“In Q4 we saw increased demand for all grades of accommodation. Hopefully this will drive further investment in the region and people will continue to want to bring their businesses to this thriving city.”

The report highlights strong take-up figures during the final quarter of the year across the ‘big nine’ cities took activity for 2015 to 9.6 million sq ft, 20% above the five year average. While overall annual occupier take-up figures across the UK’s regional city centres came in at 1.67 million sq ft, 38% above the five year average.