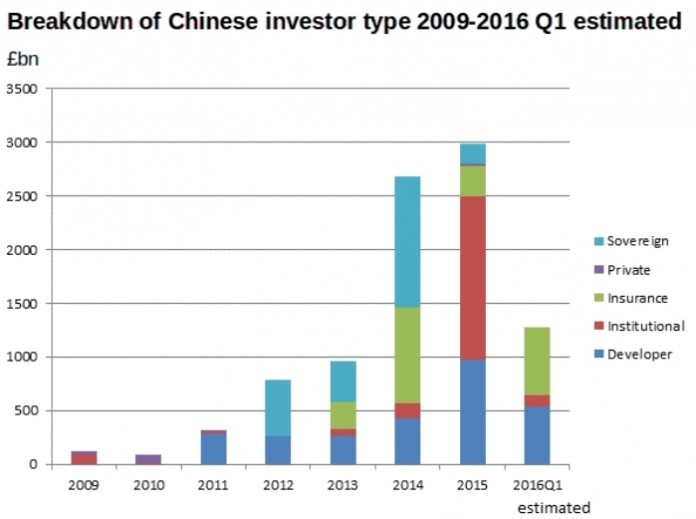

Further to the lull in investment flows in summer 2015 prompted by the volatility of Chinese financial market, Chinese investors returned to London in force in 2015 Q4 with a total of £900m within London (from China Life – Insurance, Vanke – developer, Beijing Capital Development – developer, Poly Group – developer, China Overseas – developer plus other private investors) and a further £1.4bln outside of London (Paramount theme park by SinoFortone, residential development in Midland by Jinstar, and Staffordshire University).

This trend has continued into 2016 with £740 million of transactions being processed and expected to be completed before the Chinese New Year (Aldgate tower, 88 Wood Street, and 17 Columbus Courtyard) and a further c£540million of deals anticipated to close post Chinese New Year, with Q1 this year totalling some £1.28bln (within London, from insurance, developers, institutional investors, as well as private investors).

Commenting on the latest London property to be snapped up by Chinese capital – China Overseas acquisition of The Helicon (1 South Place) – Richard Zhang head of CBRE’s China Business Team in London said: “This transaction is further evidence of the sustained appetite we are seeing from Chinese investors for prime central London office assets. This deal follows China Overseas’ debut London investment deal in 2009 (1 Lothbury) and reflects the strategy sought by a whole range of Chinese investors to increase their current allocations to overseas real estate – with London at the top of their wish list.”

According to Zhang, the controlled slowing in the Chinese economy, attractiveness of sterling and prime large lot size assets means London is still perceived as a safe haven for capital and based on the current strong levels of investment activity, total volumes of Chinese investment could even exceed the total of £3bn recorded in 2015.

Furthermore, we are likely to see the Chinese insurance companies emerge this year as the dominant source of investment capital from China into London real estate with the Chinese insurance industry’s AUM growing rapidly. For example, as one of the biggest insurers in China, China Life Insurance alone has AUM of £300bln by 2015Q4, with growth at £40bln/annum.

The current percentage of real estate investment allocation by Chinese insurers is also far less than mature markets’ counterparties, whilst seven out of 10 top Chinese insurers have in their annual meetings for the first time put overseas investment diversification among their top priority agenda going forward.