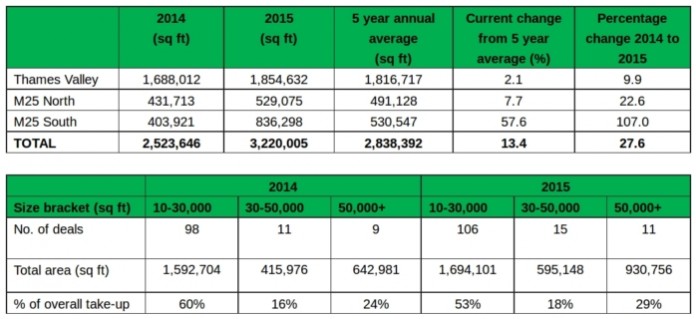

2015 saw activity in the South East reach just over 3.2 million sq ft of office space taken (in transactions of 10,000 sq ft and above). This was up 28% from the previous year and 13% higher than the five year average.

The largest annual take-up increase occurred in the M25 South region which improved dramatically from circa 404,000 sq ft in 2014 to circa 836,300 sq ft in 2015. This was underpinned by two large deals in Crawley to Elekta Ltd and Virgin Atlantic, both of which were circa 110,000 sq ft.

Activity in the larger size bracket strengthened slightly in 2015 with 11 deals over 50,000 sq ft compared to 9 deals in 2014. The table above provides an analysis of take-up across the size bands which highlights again that, as in 2014, the 10,000 – 30,000 sq ft bracket was by far the most active.

There was also a 12% increase in the volume of deals (in transactions of 10,000 sq ft and above) year on year with a total of 132 transactions across the South East in 2015 compared to 118 in 2014.

Net supply remained unchanged across the South East from the end of the preceding year at circa 12 million sq ft, which is 15% below the 5 year average. However, there has been an increase in the proportion of Grade A supply in the market. At the end of 2015, 34% of the total supply was either newly completed or under construction compared to 26% at the end of 2014. This was the result of take-up of Grade B space, loss of office space due to conversion to residential, but predominantly the delivery of new space.

The wave of speculative development continues and there are 20 schemes currently under construction across the South East that will deliver close to 1.8 million sq ft to the market in 2016. Further pipeline development is set to complete in 2017 delivering an additional 1.3m sq ft.

Luke Hacking, Senior Director in the CBRE National Office Agency Team comments: “2015 will be viewed as a robust year in terms of take-up across the wider M25 market. The success of 2016 will be underpinned by an increase in the number of 50,000 sq ft+ transactions. At this time Q1 is looking positive with the deals on Green Park to Thales (110,000 sq ft) and Bayer (80,000 sq ft) due to sign shortly and Amadeus rumoured to be close to signing an 85,000 sq ft pre-let in Heathrow.

Reading was a 2015 hotspot and saw a total of just over 500,000 sq ft of take-up (27% ahead of the 5 year average) with 72% of this in the town centre. M&G Real Estate and Bell Hammer’s decision to speculatively develop No.1 Forbury Place (183,000 sq ft) was rewarded in letting the whole building to SSE. It is hoped that Q1 2016 will see a strong start at Green Park as mentioned above.

One trend that we saw throughout 2015 was an increasing number of occupiers facing affordability or supply issues in Central London and this stimulated interest in markets from West London outwards as well Stratford and Croydon. Whilst occupiers looked, there were limited examples of this trend leading to transactions. One example was Time Inc. UK relocating from The Blue Fin Building in Southwark to Farnborough Business Park. We expect to see this trend continue in 2016 with further commitment to space outside of core Central London resulting in the continuation of the rental growth seen throughout 2015.”