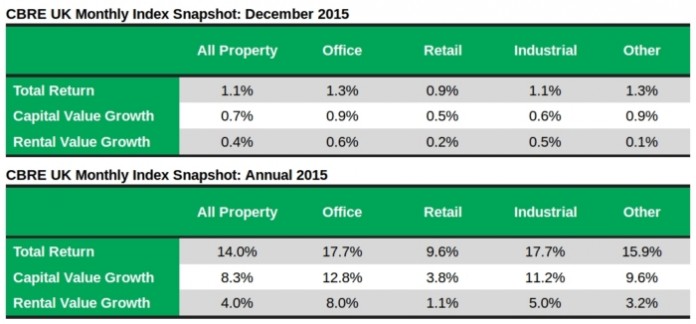

Total return on investment from UK commercial property reached 14.0% by the end of 2015, as December delivered returns of 1.1% for the month, according to the latest CBRE Monthly Index. While total returns fell short of the high of 19.7% for 2014, they have come in above the 11.5% seen in 2013.

Overall, All Property rental values grew by 4.0% in 2015, the highest growth rate since the recession. Rental value growth remained stable in December at 0.4%, where it has been since September, ending the year significantly higher than the 0.2% in January 2015 and ahead of the 0.3% monthly average for 2015. In London, both West End and Midtown offices saw rental value growth halved, slowing from 1.3% in November to 0.7% in December. Despite this significant slowdown in rental value growth, Midtown offices were the best performer of 2015, with an annual total return of 22.9%.

Capital value growth across all commercial property sectors and regions also remained flat in December at 0.7%, having been below 1.0% since January 2015. Over the whole of 2015, capital values grew by 8.3%, behind the 12.9% for 2014. The sector with the strongest capital value appreciation in 2015 was Offices at 12.8% followed closely by the Industrial sector at 11.2%.

Miles Gibson, Head of UK Research CBRE, commented: “An urgency to close deals in the last month of the year meant that total returns spiked quite significantly in December 2013 and December 2014. This simply didn’t happen in 2015. Nevertheless rental and capital values both performed well for investors in 2015, continuing the upward trend seen in the last years.”