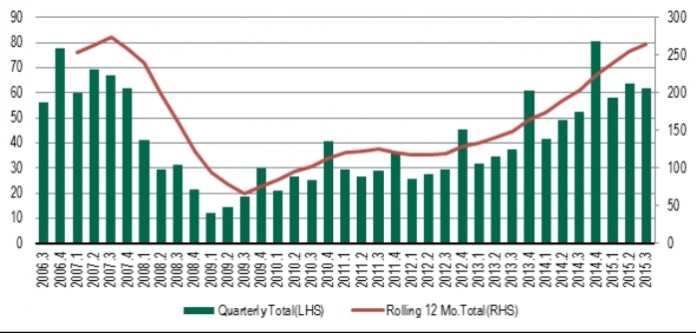

The level of investment into European commercial real estate continues to grow with €62 billion invested in Q3 2015, up 18% on Q3 2014, according to figures from CBRE.

France experienced the most noteworthy increase with investment activity of over €7 billion; almost double that of the same quarter in 2014. French investment activity was dominated by domestic investors who accounted for more than 70% of CRE investment in Q3, and who typically favoured large offices located in the Paris CBD.

Whilst France benefitted from the biggest change in investor sentiment, it was Germany which saw the greatest increase in absolute terms, with Q3 investment of €14 billion, up €5.6 billion on Q3 last year. The €36 billion already invested in German commercial real estate in the first three quarters of this year is 40% higher than the equivalent period in 2014.

Alongside France and Germany, several other countries experienced a strong Q3. Norway and Sweden saw Q3 investment volumes grow by 139% and 68% respectively on Q3 2014. Southern Europe also performed well, with Portugal and Italy benefitting from a slight shift in investor focus away from the Spanish market.

Belgium attracted near record levels of investment in Q3, boosted by several large retail transactions. In Central and Eastern Europe, Poland, the Czech Republic and Hungary saw the most investment activity.

At a city level, the most notable aspect in Q3 was the move of the Nordics up the table of Europe’s largest CRE investment markets with Oslo, Copenhagen and Stockholm making the top 10. Typically these Nordic capitals have very high levels of domestic investment (around 70%), with cross-border European investment accounting for around 25% and just 5% of capital coming from outside of Europe. However in Q3 foreign investment accounted for more than half the total in both Oslo and Copenhagen.

London and Paris continue to fill the top two spots in the league table, but interestingly all five of the main German markets make it into the quarter’s top ten for the first time since Q1 2013.

Jonathan Hull, Managing Director, EMEA Capital Markets at CBRE, commented:

“We have seen good growth across the European commercial real estate investment market in the last quarter. With high levels of transactions expected in Q4, this current trend is set to continue and we believe we will see a strong year-end in terms of investment volumes.”

“Retail recorded the strongest levels of investment growth this quarter up 45% on Q3 2014, the second highest level we have seen in ten years of data. The office sector also performed well across the region, underscored by some significant transactions in France, the UK, Norway and Sweden.”

Prime yields continued to drive downwards, with substantial falls in several major markets in Q3. Notably for all three main sectors the weighted average is now below its value in Q3 2007 – the pre-crisis low. The All Property average is down by 46 bps over the last four quarters and the rate of decline has accelerated in 2015, despite the growing expectation that short-term interest rates might finally start increasing in the next few months. There are also some signs that the relationship between prime and secondary yields is stabilizing. The prime-secondary spread had been closing rapidly since the end of 2013, but in the last two quarters it has been relatively stable.