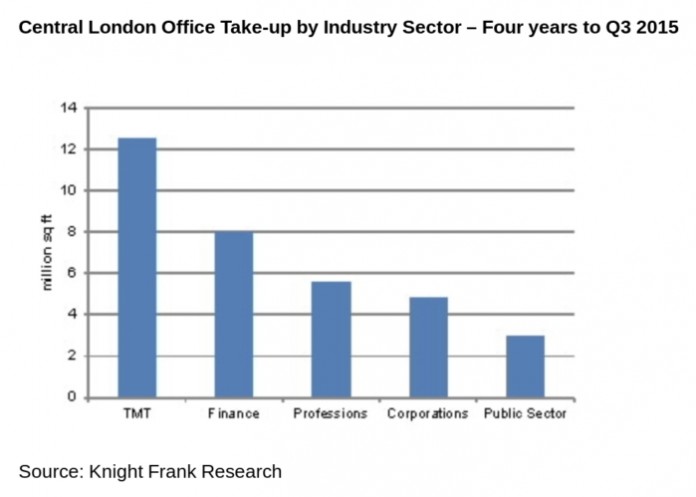

In the last four years, Technology Media and Telecoms (TMT) firms in Central London have acquired 12.5 m sq ft of offices – the equivalent of 15% of the entire West End stock – according to research by Knight Frank.

This reflects seismic changes within the office market as London reweights away from finance and towards the new digital era. Over the equivalent period financial firms have taken just under 8.0 m sq ft, and professional firms such as lawyers and accountants have acquired 5.6 m sq ft of offices.

However, the above figures probably under state the impact TMT firms are having on the market, due to technology’s infiltration of other industries. A section of financial firm take-up is made up of ‘Fin-Tech’ firms, who offer a hybrid of financial trading and the application of new technologies. Also, we are seeing more space acquired by ‘collaborative’ office centres, like WeWork, for whom tech start-ups form a large section of the client base.

As a result, office rents in popular TMT districts have surged in recent years. Rents in Shoreditch, the heart of London’s ‘Tech City’, at £65.00 per sq ft are now just shy of those in the neighbouring City Core at £66.50 per sq ft. Four years ago, Shoreditch rents stood at £40.00 per sq ft and City Core rents at £55.00 per sq ft.

Increasingly, Shoreditch is becoming a location for stage two tech firms who are acquiring the size and characteristics of mainstream companies, while the start-up scene is now migrating towards districts further east, like Whitechapel. This is a healthy progression for the market. If London is to generate the future Googles or Amazons it needs to allow the expanding firms to move out of the start-up incubators and into modern offices. It also means other parts of London will benefit from the economic uplift an influx of start-ups can bring.