The UK’s out-of-town shopping centres saw their value soar by 6% in Q3, marking the second steepest increase since 2000, according to the latest CBRE Prime Rents and Yields Monitor. Their capital appreciation dwarfed the 3.8% growth in values for in-town shopping centres, echoing a growing demand for large, dominant destinations.

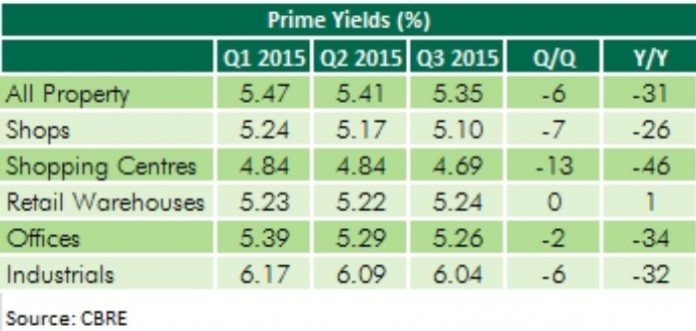

Rents also grew strongly in these out-of-town shopping centres, rising 2.1%, but even this growth wasn’t enough to keep pace with growing property values. As a result, yields were pushed down to 4.5%, their lowest level since 2000, making these sites increasingly attractive for investors looking to lower their exposure to risk.

Elevated by these out-of-town figures, the overall shopping centre sector saw capital value growth of 4.5% and rental growth of 1.6%, the highest across all prime commercial property sectors, which averaged 2.2% and 1.1% respectively. The popularity of shopping centres appears to have come at the expense of high street shops as property values in the rest of the retail sector have grown by just 2.2%, a figure buoyed by strong capital value growth in Central London of 5.5%.

Natasha Patel, Associate Director at CBRE Research said: “On the whole, we saw fairly modest capital value growth in Q3, but both rents and capital values in out-of-town shopping centres have grown remarkably. This rental growth is largely due to continued demand from retailers who are placing greater emphasis on dominant centres to strengthen their brand presence. The performance of these out-of-town sites has also contributed to a strong showing for shopping centres as a whole, pushing average yields in the sector down to their lowest levels in 15 years.”