Technology and creative firms are driving rental prices higher across the capital, particularly in areas where these firms have created hubs, according to Knight Frank which recently issued its Global Cities: The 2016 Report.

The trend isn’t just true of the UK capital. The report also shows a steady rise in rents for cities around the world that are now home to a rising number of digital, creative and technology companies.

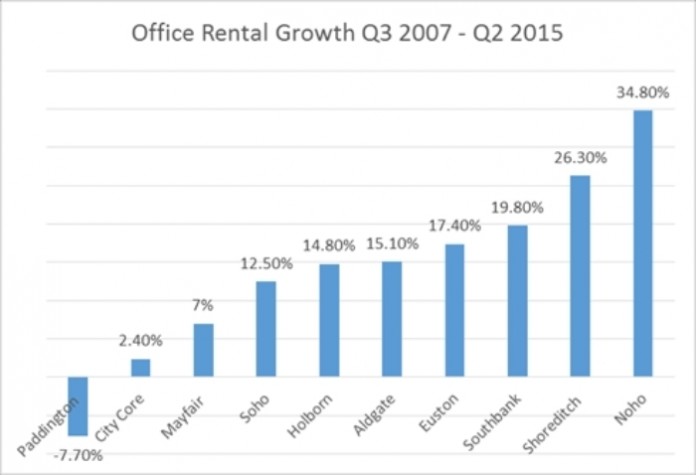

Philip Hobley, Head of West End Leasing at Knight Frank commented; “Noho has seen its rents increase by an impressive 35 per cent since Q3 2007. This is due to the continued interest from tech and creative firms such as Facebook and Estée Lauder who have been attracted to the area for its central location, dynamic street culture, strong connectivity network, all of which will be enhanced by Crossrail, and the scale and calibre of developments.”

“Taking into consideration the constrained development pipeline for Central London, the Crossrail stations with over-site development and their surrounding schemes, as well as the continued demand from occupiers to house their increased headcount, we expect the area’s positive performance to continue.”

Similarly, Shoreditch witnessed a 26.3 per cent growth and Southbank 19.8 per cent for the same period. In contrast, expensive but popular hubs like Mayfair only grew by 7 per cent while the City Core saw only 2.4 per cent growth.

It is clear that demand for office space in London remains high, and since 2000, the city has created more than 70 million sq. ft. of new space in response to this demand, which is more than the total office stock in Singapore. But the fact remains that London’s vacancy rate is at a 14 year low and falling. This has partly resulted in London, alongside San Francisco, witnessing the fastest rental growth for high-rise offices, according to the Knight Frank Skyscraper index.

Global Cities: The 2016 Report also indicates a potential boost to office rents at properties near Crossrail stations in 2017 just before completion and in 2019 immediately following. Interchange property hotspots will also be created across the city where Crossrail 1 intersects with Thameslink rail at Farringdon, and where Crossrail 2 would meet Crossrail 1 at Tottenham Court Road and then Thameslink at St Pancras.

The report highlights investment opportunities in the capital, away from the CBD where the property market is less saturated. For example the report cites that Heathrow has more office stock in the surrounding area than there is in the CBD of Birmingham.

Global Cities: The 2016 Report sets the context for investors by saying that five new cities, each the size of Los Angeles, will need to be built every year for the next five years to accommodate the expected 380 million new city dwellers. The report predicts that the number of people moving to cities over the next five years will be more than three times the current population of Japan, as they try to make the most of the economic advantages cities increasingly deliver.