A start-up that is developing a new all-in-one device for pregnancy and fertility testing has received a £2.3m early-stage funding boost.

York-based women’s health diagnostic firm Concepta received the investment from Finance Yorkshire’s Seedcorn Fund, Diagnostic Capital and Angel CoFund.

The company, founded by a group of former scientists at Unipath, is responsible for creating leading digital fertility and pregnancy tests such as Clearblue, as well as other women’s health diagnostics.

Concepta will now develop and market a diagnostic device that can accurately and simultaneously test for fertility and pregnancy, as well as monitor early stage pregnancy health.

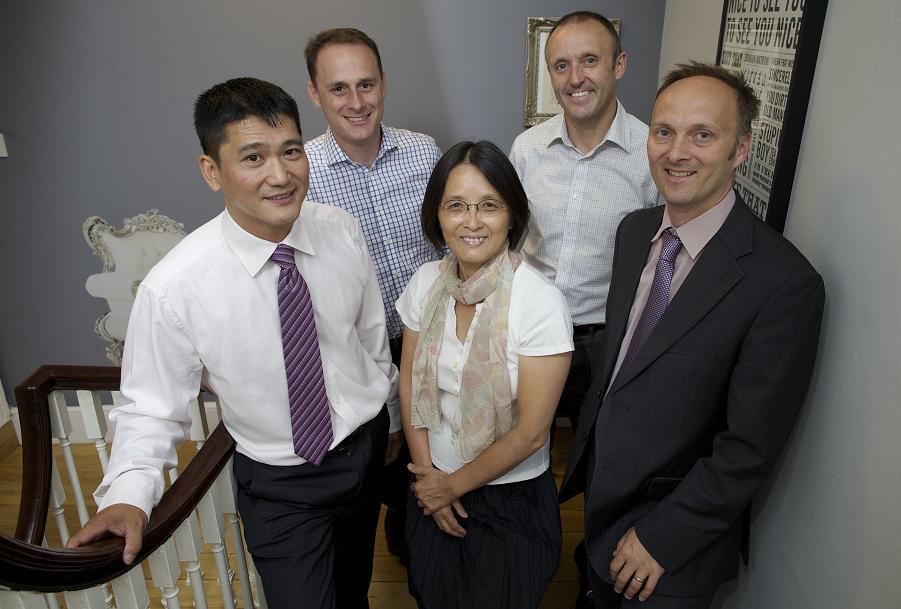

The firm has also just announced several new appointments with former CEO of Axis-Shield Dr Ian Gilham joining as Chairman, and lead equity investor David Evans joining as a Board Director.

Funding was led by a consortium of clients at Diagnostic Capital, led by Mr Evans, with investment from the Angel CoFund and significant follow-on investment from Finance Yorkshire, who have supported the management team from inception.

Finance Yorkshire Investment Director Mark Wyatt said: “We have worked closely with the Concepta team for some time, and have been impressed with their combined expertise and knowledge of this sector.

“This is a significant early stage fundraising, and I look forward to continuing to work with the company as it brings its exciting products to market.”

Tim Mills, Investment Director at Angel CoFund, said: “At the Angel CoFund we seek to support great and innovative British businesses, and Concepta certainly hits that note.

“We have been particularly impressed by the knowledge and experience of the Concepta team. The expertise Ian Gilham and David Evans bring to the table is invaluable and will be a real asset to Concepta.”

Alex Clarkson, CEP of Diagnostic Capital, said: “We are very pleased to have helped Concepta secure this £2.3m equity investment which can now combine with grants being applied for, to provide enough capital to see the plan through to full commercialisation.”

Finance Yorkshire provides seedcorn, loan and equity linked investments, ranging from £15,000 to £2m to help a range of small and medium sized businesses to meet their funding requirements for growth and development.

To date Finance Yorkshire has made 601 investments totalling more than £75 million.

The project is supported financially by the European Union. It has attracted £30million investment from the European Regional Development Fund (ERDF) as part of Europe’s support for the region’s economic development through the Yorkshire and Humber ERDF Programme, £15million from UK Government and £45million match funding from the European Investment Bank.