According to Cushman & Wakefield’s latest International Investment Atlas, published today, the global property investment market delivered US$1.18 trillion (€859 billion) of transactions in 2013 – a 22.6% increase on 2012 and the highest total since 2007.

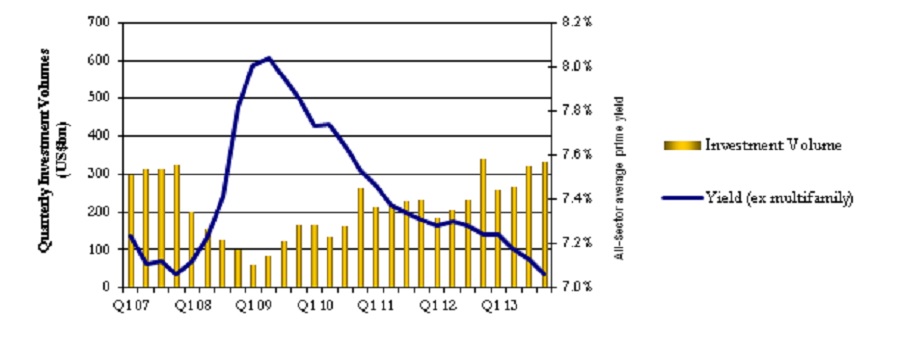

Global real estate investment turned a corner in 2013, with market activity and values picking-up as recessions ended, business sentiment rallied and increased liquidity affected most global markets. This strong annual performance has also helped to push prime yields back down to pre-crisis levels.

Looking forward to 2014, Cushman & Wakefield is forecasting a 13% increase in investment globally to US$1.33 trillion (€968 billion), with the US and Western Europe predicted to drive the uplift in activity.

David Hutchings, head of EMEA investment strategy, said: “The real estate market ended 2013 on a high on the back of greater confidence and rising liquidity and that momentum is building further this year with signs of a firmer occupier market as well as greater investment demand and new sources of debt set to drive investment activity and property pricing higher.”

Regional trends

All regions saw a positive trend over 2013 but developments within each became more diverse. Asia for example led the way for volumes thanks to growth in China as well as Japan and Australia but this had to offset declines in Taiwan, India, South Korea, Hong Kong and Thailand. Interestingly in EMEA, while trends were again diverse, the upturn was broader than in recent years, with the UK and Germany still driving the majority of regional growth but Russia, Italy, Spain, the Netherlands and Belgium all posting marked increases as did UAE, Israel and South Africa in the Middle East and Africa sub-region. At the same time, markets suchlike as France, Sweden and Poland did little more than keep pace with 2012 while Norway, Switzerland and Denmark all fell back.

The Americas meanwhile failed to be the driver behind global growth for the first time since 2009 but still produced a very strong outturn driven by the US but with a significant upturn in Mexico and a stable showing from Canada. By contrast Brazil saw a decline in volumes as did a number of smaller markets such as Argentina.

Hutchings added: “Core markets remain in high demand but a search for stock, for yield and for per-formance has rapidly led investors to look further afield, with selected emerging Asian markets, second tier US cities and Southern Europe back in favour in 2013 and that recovery is set to deepen this year.

“If investors can see past the politics, the US market must be strongly placed to outperform in 2014. All fundamentals of supply and demand point to good growth and the US market will be increasingly a target for international capital. A further improvement in the finance market is likely as CMBS comes back – this will also help the push into second tier markets.”

Cross-border investment

In all regions focused investors grew in significance and rose by 24.3% over the year versus a 22.3% increase in domestic demand, delivering a slightly increased market share of 17.6%. A significant shift in the nature of cross-border players is taking place however, with global as opposed to regional investors coming to the fore. Regional investment rose 13% while global investment was up 36%, driven particularly by investment into EMEA.

The main source of international capital is the Asia Pacific region, accounting for nearly 40% of all non-domestic spending. The majority of this is invested within the Asian region however and looking at global rather than regional spending, it is North American investors who very much drove the mar-ket, investing US$43.8 billion, 43% of the total spent outside an investor’s home region. Having said that, the fastest growing source of global capital is no longer North America – Asian investors in-creased their spending outside their region by 88% while Middle Eastern Investors beat that, increas-ing spending by 96%. By contrast North American investment outside the Americas rose 23% and European investment outside the region was virtually flat.

American players increased their regional spending – up by 44% – largely due to stronger Canadian investment in to the US, while European investment within their own region actually fell, partly due to a greater focus domestically but also due to strong competition from global players.

Pension and sovereign wealth funds remain more focused on Europe than other regions, with 59% of 2013 commercial investment (excluding land and multifamily) heading towards EMEA followed by 28% for the Americas and 13% for Asia. Country targets were relatively similar for the two with the US and the UK dominating as they do for most investor types.

Asia Pacific: 7-8% rise in activity in 2014

Asia Pacific saw the fastest growth in investment volumes of any region in 2013, with a 25% increase delivering a year-end volume of US$568.6 billion, 48% of the global market. It is notable, however, that a very significant share of this related to land sales in China, which soared 37% to US$397 billion, 34% of the global total. Asia Pacific markets are forecast to see a robust performance in 2014 against the backdrop of an improving global economy and rising domestic demand – a further steady rise in activity is forecast of 7-8%.

Demand for prime standing investments picked up in emerging markets in the final quarter, led by China for retail and offices while industrial had a strong year overall with core markets such as Japan and Singapore performing well and looking set to remain in strong demand. Vietnam and Malaysia led the way for global emerging markets, bettered only by Mexico, with volumes up 58% and 37% respectively.

John Stinson, head of capital markets in Asia Pacific at Cushman & Wakefield, said: “In Asia Pacific, changing growth dynamics and a divergence in performance should be taken as an opportunity for investors to realign their investment strategy. Parts of the region may be vulnerable to a shift in yield as capital flows change and liquidity is diverted from emerging markets by an end to quantitative easing but at the same time, better economic performance should encourage portfolio investors seeking medium-term growth opportunities.”

Europe: volumes set to increase by 12-13% this year

A strong final quarter drove volumes in EMEA to a six-year high of US$246.3 billion in 2013, 23% up on the previous year.

The story of the year was the bounce in activity in peripheral markets, led by Southern Europe which rose by 107%, but demand in the core remains high, supported by a greater availability of debt, and the big three of France, Germany and the UK saw a 24% rise in volumes, thus maintaining their mar-ket share of 66%. Opportunistic investors have made their presence felt and foreign demand in gen-eral has been a key part of the renaissance of European markets, which are forecast to rise by 12-13% in 2014.

“The market is on fire in EMEA. Overall demand is still rising as institutional allocations are raised and foreign interest increases. Greater debt availability and lower pricing is adding to buying power and while still restricted to prime in many areas, risk appetite among lenders is improving, leading to a slow broadening in availability. Alongside an appetite to invest quickly, this has helped to support a stronger level of interest in portfolio sales,” comments Jan-Willem Bastijn, Cushman & Wakefield’s head of EMEA capital markets.

Latin America: Mexico emerges as a growth market

Investment activity in Latin America fell 13% in 2013 to US$5.7 billion after a weak second half. The fall was due to a decline in global investment, with domestic investment increasing 38% but foreign investment falling by 61% to just 21% of the total, its lowest market share for three years.

Marcelo da Costa Santos, head of capital markets in South America at Cushman & Wakefield, said: “With Brazilian investment volumes falling by three quarters last year, Mexico emerged as a growth market for the region with a surge of activity driven by new REIT vehicles and a strong performance in the industrial sector. While demand has increased in some tier 2 cities, there has been no let up in interest in core product, with prices pushed higher as competition remains strong.”

Intra-regional trading held up as North American and Chilean funds continued to show demand and a number of larger deals demonstrated investor faith in the long term potential of the market. However, some other global players have taken a shorter-term perspective and turned towards different global markets where risks are deemed to be lower, such as recovering markets in Europe. At the same time a number of major local players have diverted some investment outside the region as they in-crease their global profile.

North America: investment volumes to jump by a fifth in 2014

North America saw its best quarter since 2007 in Q4 2013 and while growth was not quite as strong as in Asia and Europe for the year overall, there was still a 19% rise in overall volumes to US$359 billion, 30% of the global market. The US itself has driven the increase, with demand in Canada strong but activity level pegging with 2012 as the market was held back by high prices and stock shortages.

North American volumes are forecast to rise 20% this year with the US remaining the engine of glob-al growth amid signs of a stronger economic and real estate recovery. Job growth is expected to be stronger, corporate earnings are growing and signs are positive for increased consumer and busi-ness spending.

Cushman & Wakefield’s CEO of the Americas, Jim Underhill, said: “Strong capital flows into the sec-tor in the US were supported by both equity and debt markets, with more competition emerging to both buy and to lend, supported by an improving economy and the flow through to real estate market fundamentals. The senior debt market has been strong for some time and the mezzanine debt market is also highly liquid where the LTV ratio is conservative. A further improvement in finance market conditions is likely this year as the CMBS markets expands.”

Global outlook

A realistic appraisal of the macro environment should support further robust demand for property as an investment and this will be underpinned by the availability of debt and the supply of available product from profit takers, deleveraging banks, investors and developers moving up the risk curve and businesses and the public sector raising capital.

Bastijn said: “We are forecasting a 13% rise in investment globally to US$1.33 trillion in 2014, with the US and Western Europe driving the increase. At the same time yield pressures will push capital values up, with the yield gap between prime and good secondary closing as investors reappraise and re-price risk. Rising interest rates will put a ceiling on how far yields can move but the sector has a cushion in high yield premiums and pricing will also benefit from a slow return of occupier demand. This recovery is taking place more rapidly than many expected and speed is likely to remain a feature of the market. However, the investment recovery is running ahead of the tenant market in general, albeit to differing degrees, and hence the profile of the recovery will be front-loaded.”

Hutchings concludes: “Real estate is a ‘buy’ based on relative pricing, risk and prospective growth. However not all property is equal – some countries are more reformed, innovative and productive while some cities are innately more competitive and attractive than others or the countries they sit in. Markets are therefore becoming more idiosyncratic and driven by their own individual advantages, leading to a more divergent global market with real winners and losers.

“A long list of geopolitical tensions from the Middle East to the South China Sea will continue to gen-erate uncertainty, most recently with Ukraine added to this list. Whilst it is too early to gauge how this will develop and influence markets, it is at the very least an added reminder of the risks that exist in cross-border investment generally and emerging markets specifically and hence should continue to urge investors to focus on the real individual level of risk market-by-market as they expand their in-vestment horizons.”