The European retail sector ended 2013 on a high note with quarterly volumes soaring 75% to their highest since 2007 as a combination of rising confidence, an improving supply of equity and debt and a spreading of demand across multiple markets opened the door to more activity.

However while year-on-year volumes rose to their highest since 2011, more rapid progress was made in other sectors as supply shortages held back retail activity to a somewhat greater extent. Retail volumes rose 17% on the year while offices rose 23% and industrial a more notable 57%. As a result retail market share for the year overall fell back to 23% from 25% in 2012.

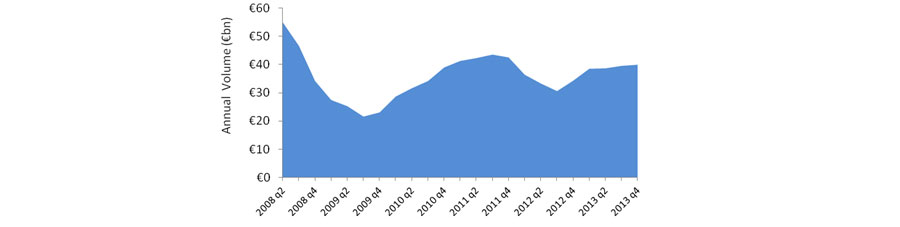

Chart 1 – Retail Property Investment in EMEA

Source: Cushman & Wakefield, KTI, RCA, and Property Data

The majority of investment is focussed on the shopping centre market which gained further ground in Q4 but private buyers and occupiers remain keen investors in the core high street market.

According to Michael Rodda, head of EMEA Retail Investment at Cushman & Wakefield: “Quality supply is tight and demand is ahead of availability in what is still a vendor’s market. As a result we continue to see buyers look further afield to find quality stock, with Southern Europe buoyant in late 2013 and likely to be an even stronger focus for many players this year.”

The market overall is awash with cross border investors with more Asian players looking at retail but North and South American capital of greater note at present.

According to Rodda: “What’s been particularly interesting of late has been the amount of capital we have seen being diverted from other areas of the world towards Europe. Obviously a renewed faith in the euro is a key part of this, but with some emerging markets in other regions proving hard or expensive to access, investors are also clearly being attracted to Southern Europe by the quality of schemes, the availability of experienced managers to work with and the transparency of shopping centre incomes.”

The big three of the UK, Germany and France meanwhile saw volumes rise 62% in Q4, with German volumes doubling but French volumes trebling. UK volumes rose at a less dramatic but still buoyant rate of 34% and it remains the largest retail market in Europe, accounting for 29% of all retail trading for the year.

Some other core markets lost out meanwhile, with volumes in the Benelux down 25% and the Nordics held back by a shortage of opportunities, with activity down 16% despite a strong final quarter.

In Central & Eastern Europe retail took a 32% market share in Q4 as volumes rose 15% thanks to a jump in Russia as well as high demand in Poland. However it was the euro zone’s previously distressed markets which showed the biggest upturn, with an 82% volume increase in Q4 driven by Spain and Italy but with Greece, Ireland and Portugal also picking up from a low base.

Chart 2 – Top Retail Investment Targets

Source: Cushman & Wakefield, KTI, RCA, and Property Data

Looking forward, there is clearly an increasingly positive consensus in the market after retailer trading stabilised last year and is expected to start to rise in most markets in 2014. Retail sales volumes are in fact forecast to increase 1.4% in Western Europe this year and by 3.5% in CEE after gains of 0.1% and 2.3% respectively in 2013.

High quality retail assets in established core markets should therefore remain in strong demand even as a shortage of supply and demand for yield leads more investors to look more widely, focussing further on Spain and Italy before moving on to Portugal and perhaps Central & Eastern Europe later in the year.

Commenting on these patterns, David Hutchings, Head of EMEA Investment Strategy at Cushman & Wakefield said: “There should still be a note of caution in the market since not all deals are good deals and quite fundamentally retailing across the region will remain polarised, caught between on aggregate an oversupply of space and at best an increase in cost sensitivity due to structural changes such as e-tailing. Nonetheless, a greater breadth of demand suggests volumes will rise further, with a 13% rise to €45bn easily supportable by current fundamentals but clearly dependent on investors continuing to broaden their horizons and enough stock of the right quality coming available.”