Investment activity in the South East office market reached a seven-year high in the second half of 2013, according to Knight Frank.

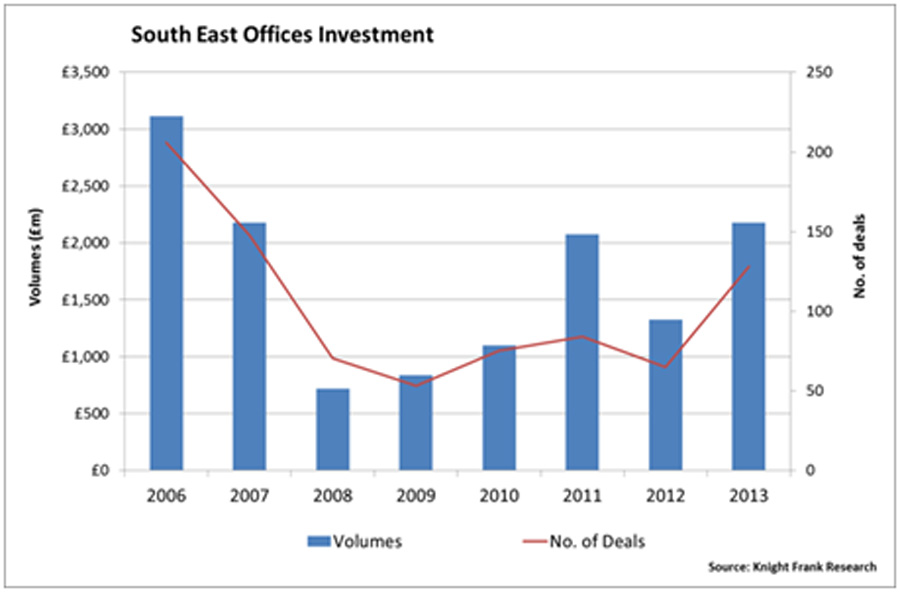

A clear resurgence of investor demand for South East offices since last summer was reflected in strong levels of activity throughout H2. Q4’s turnover of £705m took the total for the second half of 2013 to £1.48bn, more than twice the level seen in H1 2013 and the strongest half-yearly total since H2 2006. There was also significant depth to the market, with 46 deals in Q4 taking the total for H2 2013 to 78, also a seven year high for the market.

Despite a clear focus of activity coming in H2, it boosted volumes for 2013 as a whole to £2.2bn, the highest annual total since 2007.

The recent surge of investment has been driven by the UK Funds, who continue to seek better value opportunities outside Central London and who are in a position to deploy significant amounts of capital. Key deals in Q4 included M&G Real Estate’s £52.25m purchase of Enterprise House, Uxbridge from SWIP, reflecting an NIY of 5.78% and Aviva’s £48.2m purchase of the King Portfolio from SWIP, which includes offices in Stockley Park, Leatherhead and Croydon.

However, overseas investors are also particularly active in the South East market with, for example, Japanese investor Tecmo Koei Europe Ltd’s purchase of Crest House, Chertsey from L&G for £8.4m reflecting a net initial yield of 6.19%.

Tim Smither, Partner at Knight Frank said:

“Recent activity has been very strong and there continues to be a substantial weight of money chasing limited stock. While it remains to be seen whether recent levels of turnover will be matched in 2014, this is likely to put prices under further pressure. We expect prime yields to harden from the current 5.50% during 2014, as domestic and overseas investors chase a very limited pipeline of stock”

Buoyed by clear signs of recovery in the occupier market, we also expect investors to increasingly consider opportunities higher up the risk curve, albeit focused within the robust markets which offer good re-letting prospects”.