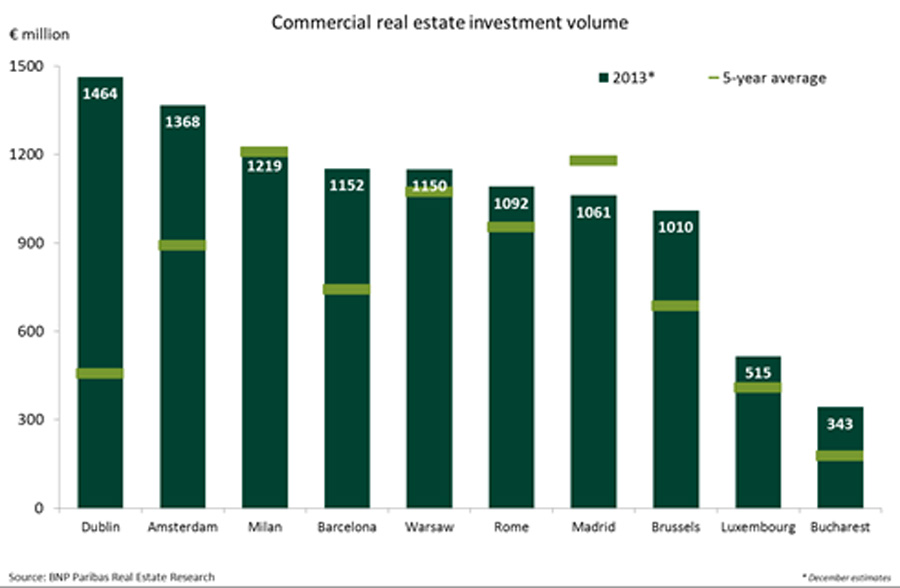

If the United Kingdom, Germany and France still represent 80% of the real estate market in Europe, investors are showing greater interest in the following ten tier two markets: Warsaw, Dublin, Amsterdam, Milan, Barcelona, Rome, Madrid, Brussels, Luxembourg and Bucharest.

“Last year, more investors looking for higher potential of value creation were opting for tier two markets opportunities. The volume of commercial real estate investment increased by 73% in 2013 compared to 2012 and is expected to achieve € 10.4 billion,” said Guillaume Delattre, Executive Regional Head, International Advisory, BNP Paribas Real Estate. “The ambition of BNP Paribas Real Estate is to develop its activities on this perimeter and to consolidate its leadership in core markets.”

With some exceptions, like Poland and Romania, the European tier two markets are still weighted down by a challenging environment. This year shows a marginally better prospective, with flat or slightly positive GDP growth. Tier two markets have probably reached a low point in terms of rents and a high point in terms of vacancy rate due to the past, present and future weak volume of new construction.

The spread between office prime yields in core markets of Paris, London and the big four German cities, and tier two markets has never been so high; giving a well-compensated risk for these less liquid markets. The gap between average office prime yields in core markets and in tier two markets achieved an historic high of 160 bp at the end of 2013; while it was bottoming out at 45 bp in 2007.

“The growing interest showed by foreign investors is another sign of the recovery of the tier two markets. In 2013, 70% of the investment volume was done by cross-border investors compared to 46% in 2009. Most of cross border investors come from the Eurozone and North America,” added Céline Cotasson-Fauvet, Senior Analyst, International Research, BNP Paribas Real Estate.

*all figures in this press release are based on December 2013 estimations

Investment market: highest volume since 2009

The commercial real estate investment volume reached € 10.4bn in 2013, with an increase of 73% compared to the same period last year. Investors largely favor office premises (51% of total investment volume) that recorded the most buoyant rise (up 45% on 2012). In fact, office investment volume saw a new high since 2009, thanks to large deals recorded during the final quarter, whilst retail investment volume registered a 41% increase compared to 2012.

Occupier market: drop continues but at a slower pace

The ten tier two markets reached 2.3 million sq m in 2013; slightly decreasing by 3% compared to 2012. The office occupier market is still weighted down by the weak economic backdrop. Even though the level of construction stays frozen, the low net absorption does not stop a rise in vacancy rate. Consequently, downwards prime rents corrections still occur in the markets where vacancy rates increased the most.

Focus

Besides a drop of 14% compared to 2012, Warsaw is a rather solid market. In 2013, the investment volume totalled approximately € 1.2bn, dominated by 63% of office investment. The investment market in 2013 was marked by 120 million euros deal on the Senator office building (24,600 sq m). On the office occupier side, take-up slightly progressed in 2013. Vacancy rate should keep on increasing, due to a very dynamic development pipeline.

Dublin continues on the road of recovery. With a total of € 1.5bn, the investment volume is expected to triple compared to 2012. The competition over prime properties in the Dublin market is continuing to impact on yields. North American investors have made a marked return to the Irish commercial real estate investment market since 2012 with some major deals in Dublin: Bishop Square (14,300 sq m of offices for 65 million euros) and the Ulysses portfolio (25 units for 155 million euros). The occupier market fundamentals are strong; take-up rose steadily, prime rents gained 16% and vacancy rate dropped from 18% to less than 14% between 2012 and 2013.

The Netherlands are on the way out of recession, with a positive outlook. The investment market has been constantly growing since 2009. Foreign investors, mostly from the Eurozone, are confirming a growing interest. Some large hotel investment deals took place, such as the Krasnapolsky in Amsterdam (468 rooms for 157 million euros). On the occupier market, take-up slide a little in 2013 compared to 2012. Vacancy dropped 2% but remains high (17.7%) and prime rents stood still for a sixth consecutive quarter.

The commercial real estate investment volume in Milan and Rome increased sharply in 2013 compared to 2012 and shortly exceed their five year average, amounting to € 1.2bn and € 1.1bn, respectively. Even though Italian investment markets are traditionally mainly domestic ones, they have been increasingly targeted by foreign investors. In Milan in particular, there was a major deal closed by a Qatari sovereign fund: Sviluppo Porta Nuova-Varesine in Milano, a mixed development of 35,000 sq m of residential, 69,000 sq m of offices and 9,000 sq m of retail for a total of 400 million euros. Office market fundamentals plummeted due to the recent economic context. Vacancy rates continued to rise, while prime rents are dropping. Take up in Rome was up in 2013 due to the 42 000 sq m BNL transacted next to Tiburtina station; whereas Milan office take-up was down 31% compared to 2012.

Many investors find the current situation favourable for taking positions in commercial and residential real estate. The recovery expectations for 2014 are the trigger for the generation of “core+” and “added value” strategies. With an aggregate volume of more than € 2.2 billion, investment is 74% up in Madrid and almost tripled in Barcelona. The retail investment volume moved away from offices with, for instance, the sale of the retail facilities of El Corte Inglés in Barcelona for €96 million. Moreover, in 2013, US investors were the most active and were involved in five out of every six transactions in the residential market for a total volume of 610 million euros.

In 2013, investment volume totaled € 1billion euro, up 64% on 2012’s volume. A performance which is the consequence of an exceptional second quarter that saw several major transactions signed. In 2013, the most representative deal was the sale of the Belair Project (64,300 sq m for 300 million euros) to a Chinese-German consortium. Lease activity in the Brussels office market decreased by 26% compared to 2012 and stood well below the five year average. Prime rents remained steady thanks to relative scarcity of prime quality space.

Even though coming from a low level, the Luxembourg investment volume recorded a marked increase of 62% between 2012 and 2013. A couple of large transactions sustained this recovery. The most significant being the sale of Knauf Pommerloch, a 26,000 sq m shopping centre for € 96.5 million. The investment activity is also sustained by quite a robust occupier market. Indeed, despite a gloomy economic backdrop, take-up only contracted by 3% between 2012 and 2013 and stays in line with the five year average. Moreover, the low level of supply ensures a good resilience of prime rents that has remained constant for the last two years.

In 2013, the investment market in Bucharest has started to gather momentum with positive perspectives for investors on the medium term. Of course, the increase of 170% recorded between 2012 and 2013 has to be put into perspective with a particularly low investment volume. Indeed, investors are encouraged by a resilient occupier market and by interesting prime yields compared to other CEE real estate markets. However, the limited availability of senior debt remains a major investment barrier, in particular for domestic investors. Thus, demand is mainly sustained by foreign opportunistic funds. The biggest transaction of the year was concluded by NEPI, a core investment fund listed on three stock exchanges: Bucharest, Johannesburg and London, which acquired The Lakeview office building for a €61.7 million.