The Central London office leasing market is firmly on the road to recovery, bolstered by an ever more positive economic scenario, expectations of declining supply and rising rental values according to figures released today by Cushman & Wakefield.

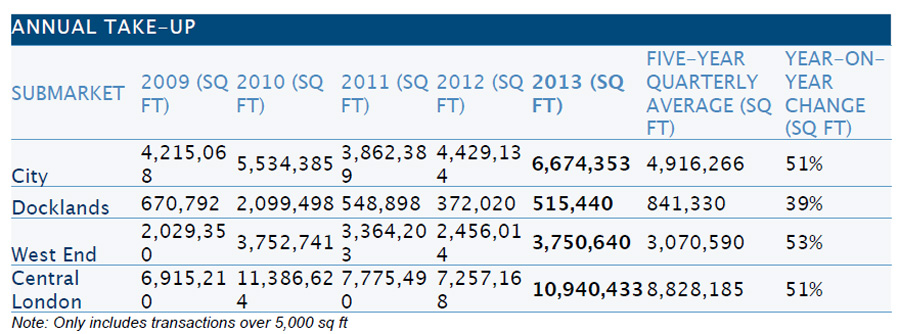

Cushman & Wakefield anticipates that take-up of office space in Central London for the year to December will be almost 11 million sq ft, significantly above the 2012 figure of 7.3 million sq ft. This is an increase of more than 50% year-on-year.

Positively, leasing activity has increased across all Central London markets and transaction volumes are 22% above the five-year average. The number of transactions over 50,000 sq ft has been a major driver of leasing volumes, with 30 deals signed this year – the highest number since 2007.

Across Central London, the Media & Tech sector continued to dominate activity accounting for 36% of all letting volumes in 2013, up from 23% in the preceding two years. This sector is expected to continue to drive activity into 2014, although the firm expects activity from the banking and financial services sector to account for an increasing proportion of leasing volumes, especially in the City.

Leasing activity in the City office market increased quarter-on-quarter and reached just under 2 million sq ft in Q4 2013. This is the highest quarterly volume since mid-2007. As a result, annual take-up reached 6.5 million sq ft; a third higher than the five-year average. There was a significant increase in the volume of pre-letting deals during 2013, to just over 2.0 million sq ft, and there were over 10 prelets signed for over 50,000 sq ft which was more than the previous three years combined.

Cushman & Wakefield’s head of City office agency, Andrew Parker, said: “The City office leasing market continues to go from strength-to-strength, which has been reflected in the number of occupiers committing to pre-lets, in anticipation of a shortage of space. In fact almost a third of all space let in the City this year has been pre-let. The imbalance between supply and demand for larger units will continue to characterise the market and we expect the number of pre-lets to increase further in 2014.”

Following a year of subdued activity in 2012, the West End office market recorded growth of more than 50% during 2013 and as a result leasing activity reached 3.75 million sq ft. This is the highest volume of annual transactions since 2007. The Media & Tech sector was the dominant sector this year, accounting for 1.6 million sq ft, which is more than double the volume recorded in 2012, but 2013 witnessed the re-emergence of both energy and financial services activity. There was also an upturn in pre-letting activity in the West End, with volumes doubling year-on-year to reach 1.2 million sq ft.

Andy Tyler, head of West End office agency at Cushman & Wakefield, said: “2013 witnessed the turning point in the market and we are confident that the momentum seen in the last 12 months will continue into 2014. Business sentiment is increasingly positive across all sectors and take-up volumes will continue on their upward trend. With vacancy rates remaining low, we expect pre-lets to be a major part of future leasing activity. “

The volume of space under offer across Central London suggests a strong start to leasing volumes in 2014. An estimated 2.2 million sq ft remained under offer as at Q4, which is up 16% on the previous quarter and above the five-year average figure of 1.9 million sq ft.

The increasing volume of leasing activity combined with stable levels of supply has placed rental values under pressure. Prime rents in the West End reached £110 per sq ft and in the City increased to £57.50 per sq ft by December 2013: an annual increase of 5% in both markets. Prime rental growth is expected to strengthen during the following 12 months, with annual growth of 9% in the West End and 8% in the City anticipated.