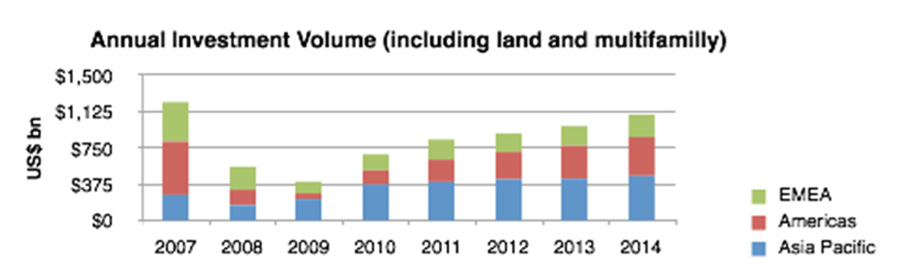

According to Cushman & Wakefield’s latest capital markets research, the global property investment market is picking up momentum. Volumes are set to rise 10-15% in 2014 to back above US$1 trillion for the first time since 2007. This comes after an estimated 8.4% increase delivered 2013 investment sales of US$978bn.

According to David Hutchings, Head of EMEA Research at Cushman & Wakefield: “The growing level of optimism and activity we are seeing in most regions has its roots in a belief that the global economy is set for calmer waters ahead and that financial imbalances are on the mend. This is leading to an increase in risk appetites which is manifest in a push to invest across borders, a move towards second tier assets and a narrowing in the prime to secondary yield gap.”

The speed with which sentiment has turned is surprising many and leading some to question whether investment markets are getting too far ahead of the occupational cycle. Some in fact believe a liquidity driven bubble is building up in some areas which will burst when the Federal Reserve and others start to rein in quantitative easing. However while there are ongoing downside risks and the recovery is very much multi-speed, tapering should be co-incident with better economic and corporate confidence – and hence should be accompanied by better occupational demand and growing property incomes.

Overall Hutchings suggests “With bond yields already increased, the main impact of an end to QE will be felt in emerging markets as liquidity drops. However it should also be taken as a reminder that investors need to stay focussed on fundamental real estate drivers. In particular the mismatch between supply and demand must be understood, and this is both in terms of quantity and quality given the changes underway in what occupiers actually want.”

The Outlook in 2014 by Region

Volumes have risen most rapidly in the Americas but EMEA and Asia are both expected to pick up next year, with foreign players a key part of this. Cross border activity is already growing in all areas, to above 12% in the Americas and Asia for example, but standing at over 40% in EMEA and likely to rise further.

Change in Investment on 2013 Change in Investment in 2014

Source: Cushman & Wakefield, RCA. All sector including land and multifamily

America’s leading the way again

The America’s have led the way once more for growth this year and look set to repeat this in 2014, with an 18-20% increase forecast. The US is very much the engine for this, with Canada growing but held back by high prices and stock shortages while Latin America has seen a mixed picture.

“With leasing markets firming, the US has a smaller lag between occupational and investment cycles than most other markets” commented Rob Griffin in the US Capital Markets team at Cushman & Wakefield. “However while better recent jobs data is encouraging a more upbeat mood it is also bringing forward the start of tapering and a further increase in bond yields. Prime yields are therefore likely to largely mark time in the months to come but with more demand and financing, I can see secondary yields continuing to edge down as the recovery in jobs spreads out.”

Looking to Latin America, while downside risks remain, the general prognosis is for the economy in most countries to be somewhat stronger which will be a positive for occupier demand across the region. According to Marcelo da Costa Santos, Vice-President, Capital Markets South America at Cushman & Wakefield, “Thanks in particular to growth in Mexico and stronger demand in the industrial sector, investment activity is up this year despite the less stable economic background and with that now firming, we expect investment volumes to rise again in 2014. Mexico will remain in high demand, as will Brazil as the spotlight of the World Cup gets stronger but a range of other regional markets are gaining favour, led by Colombia and Peru.”

Polarizing markets in Asia Pacific

In Asia Pacific, a 5-7% increase in trading activity is forecast for next year after a modest rise of 1-2% in 2013, with growth tracking that of the economy and delivering slower but also less volatile performance than in recent years. Within the region however trends are going to be heavily polarized according to John Stinson, Head of Capital Markets in Asia Pacific for Cushman & Wakefield, “Investors in core markets are accepting that lower returns are the new normal but they are also looking forward to more stability and hence are happy to invest in core assets for the long term. Those with shorter term or higher return horizon however are ready to make sales in the core to redeploy their capital to higher growth sectors and geographies. Emerging Asian markets are therefore likely to be busier next year with Manila, Jakarta and Bengaluru offering great potential according to our research”

At the same time, Asia will continue to export capital at an accelerating rate both within the region and around the world with emerging markets favoured in Asia but core product in core markets top of the agenda in other global regions for now. According to Stinson, “The impact of Asian players on the global stage is set to grow exponentially, with China and Japan both increasing their overseas spending and second and third tiers of institutional and private capital also set to flow faster from areas such as China, South Korea, Malaysia and Singapore.”

Europe has strong upside potential

European volumes are forecast to rise 13-15% next year and while this may only be a 6 rather than a 7 year market high, the recovery is deepening and with more regional and global capital being diverted towards property, there appears more upside than downside potential in 2014. According to Jan Willem Bastijn, Head of European Capital Markets at Cushman & Wakefield, “We have an increasingly optimistic view for activity in Europe next year. We’re assuming a sharpening in prices helps to bring stock to the market to feed this but it will be the stock question that decides how high we can go, given the weight of capital and now better availability of debt.”

Geographically, the European market is broadening out, with opportunistic players leading the way in to what were previously overlooked areas in southern and eastern Europe, typically seeking core quality assets in large cities. According to Bastijn “With austerity easing and economic growth slow but generally up, better news will continue to spread out in occupier as well as investor markets. However supply will be the big factor for occupiers not just investors in 2014, with a lack of development impacting on choice and leading to higher pricing and in all likelihood better performance in some non-core markets.”

Investment Volume (US$bn) 2012 2013 2014

Americas $278.5 $335.4 $399.1

APAC $431.6 $439.2 $465.6

EMEA $192.1 $203.1 $231.5

Global $902.2 $977.7 $1,096.2

Cushman & Wakefield, RCA (all sectors including land and multifamily)