Cushman & Wakefield’s latest European capital market research reports that the commercial property sector is enjoying a strong close to the year, with Q3 trading volumes up 17.7% on the same period of 2012 and the market actually seeing its strongest third quarter since before the crisis hit in 2007.

According to Jan Willem Bastijn, Head of Capital Markets at Cushman & Wakefield, EMEA, “There is now a real momentum building and the real estate sector is set to move quicker than most expect. The market is already going through the gears quickly; firstly we had demand moving into second tier core markets, then we had demand in top tier cities in previously overlooked areas like southern Europe, now we have demand for better quality secondary assets in top cities.”

Investors remain keen to buy in the core of Europe, with both France and the UK up strongly in Q3 and Germany strong but stable. Overall the top 3 took a near 65% share of the market, up from 57% in Q2. Nonetheless, a range of investors have shown themselves ready to take on more risk, moving from market to market to find opportunities. In Q1 it was Eastern Europe that benefitted, rising 167% while the market fell 26% on the previous quarter, in Q2 it was Southern Europe, rising 101% against a market increase of less than 2%, while in the third quarter Central Europe took up the running, with a 179% increase contrasting with the markets 5% rise.

By country, the Czech Republic, Poland, the Netherlands, the UK and Ireland saw the better growth in activity in the past quarter and as demand has spread, values have stabilised. Yields in fact are under downward pressure in more and more prime markets and while the fall to date has been limited – just 8bp so far this year, lifting capital values by an average of 1.1% – the gains in leading markets have been greater and these improvements are expected to accelerate in the coming months.

“Where demand will spread next is not clear given how footloose some capital is in pursuit of the right product, but what does seem sure is that the pricing correction which has started is only going to accelerate and this will happen a lot sooner than many are predicting.” commented Bastijn.

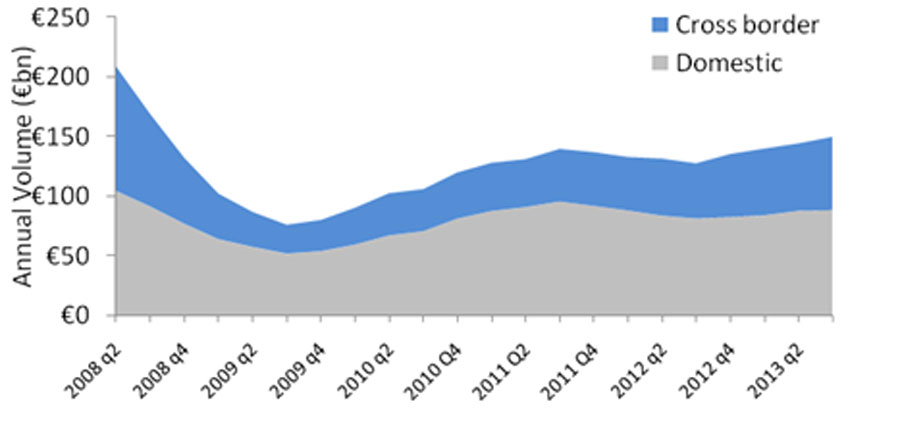

Over the quarter, industrial and offices drove the growth in activity, up 19% and 18% respectively while retail fell 10% thanks to a shortage of opportunities as well as finance in some areas. Offices saw their market share rise back above 52% as a result while industrial edged towards 10% and retail dropped to 21%. Cross border players meanwhile made their presence felt after a slower first half, taking a 43% market share compared to 39% in H1, Indeed, while domestic investors pulled back by 2.1% in their total trading activity, overseas players pushed up their activity by 16% to €15.5bn.

According to David Hutchings, Head of European Research at Cushman & Wakefield, “A strong end to the year is clearly underway and we have lifted our forecast for year-end trading volumes to €145bn, 9% up on last year. With Europe being singled out as offering some degree of recovery potential but also a growing supply of opportunities and a falling level of risk, foreign players will continue to be drawn to the region and their market share is likely to escalate, hitting over 41% this year and going higher next year as more Chinese and other Asian players get into their stride”. Foreign players won’t have the market all their own way however with domestic fund, REIT and private buyer demand also set to increase in an environment of still low interest rates but declining occupational risk for the best space. As a result, “with more fuel going onto the fire thanks to improving finance markets and a growing pipeline of stock, the market is only likely to get busier in 2014” concluded Hutchings.