The UK shopping centre development market has rebounded strongly in 2013, according to research published today by the world’s largest privately-owned real estate services firm, Cushman & Wakefield.

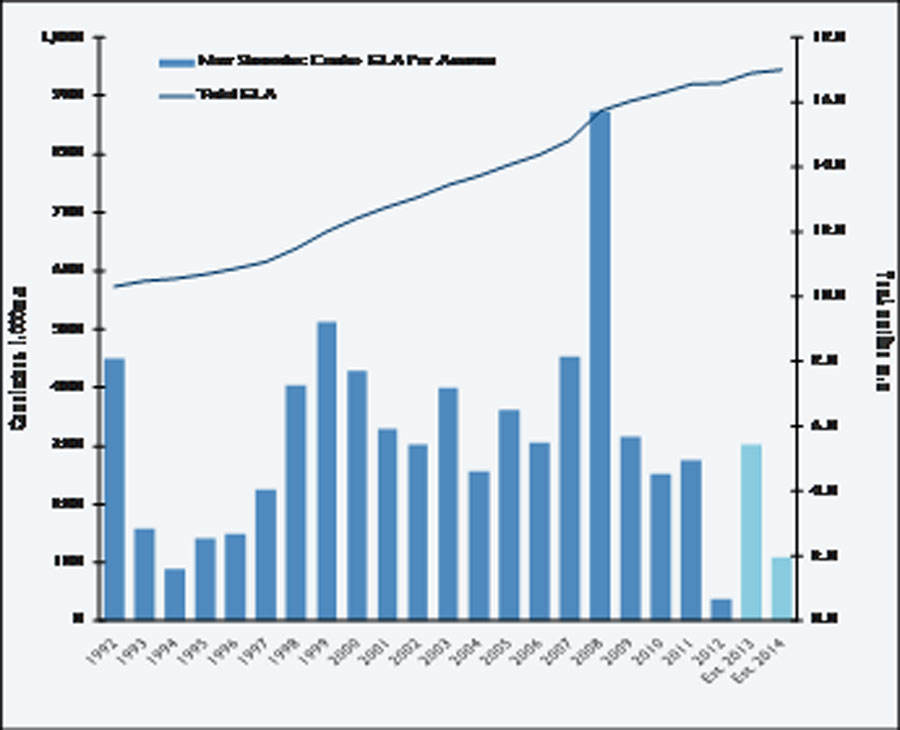

In the first eight months of this year, 238,800 sq m of new shopping centre space was added to the market. This is in stark contrast to a very subdued 2012 when only 37,000 sq m became available, the lowest recorded level of shopping centre development activity since 1962. Total shopping centre floor space in the UK now stands at over 16.8 million sq m spread across 710 schemes.

While only one new scheme opened last year, the Tesco-anchored Swan Centre (15,600 sq m) in Eastleigh, eight new centres have already completed so far this year, with the most notable being Trinity Leeds (75,900 sq m) which opened in March. Other key projects this year have included West Bromwich’s New Square (43,900 sq m), which opened in July, and the redevelopment of the Whiteley Village Outlet in Fareham into the new Whiteley Shopping Centre (28,000 sq m).

More than 91% of all shopping centre space which has opened this year came from brand new shopping centres – the remaining space, approximately 21,900 sq m, was delivered through seven extensions. Ranging in size from 500-7,500 sq m, these extensions represented 9% of all new space; significantly down on last year’s 58%.

Schemes in the pipeline which are currently under construction and pencilled in for the latter part of 2013 are expected to add another 62,700 sq m of gross leasable area (GLA) to the market. This would bring the total for the year to its highest level – 301,500 sq m – since 2009. This additional space is comprised mostly of extensions to existing schemes, with two of the most significant being the second phases of Central Village’s Lewis’s Building (15,900 sq m) in Liverpool and The Crown Centre (9,300 sq m) in Stourbridge.

However, when compared to 2013, shopping centre development activity for 2014 is expected to slow with just over 109,100 sq m of new space scheduled for completion next year. The Hereford Retail Quarter (28,000 sq m), the Grand Central extension (25,100 sq m – part of the Pallasades redevelopment) in Birmingham and Parkgate Shirley (15,900 sq m) in Solihull are the three largest projects of the 10 expected to come onto the market in 2014.

Investment activity in the UK shopping centre market has accelerated dramatically in the first half of 2013, with £1.9 billion-worth of shopping centre assets traded and activity across the spectrum pushing yields down. This total amounts to more than double the £800 million of shopping centre assets transacted in the same period last year.

Cushman & Wakefield retail development partner Alistair Parker said: “Although shopping centre development activity will slow down next year, 171,800 sq m of new space will be added to the market in 2013-2014, which is a good base to build on and will only increase if economic conditions continue to improve. Leasing activity will remain strongest in the regionally dominant shopping centres, with occupiers targeting larger, well-configured units.”

Martin Mahmuti, senior research analyst in Cushman & Wakefield’s European Research Group, said: “Notwithstanding the strong rebound witnessed this year, the development pipeline remains limited as occupiers and investors try to adjust to changing consumer behaviour and wait for a lasting economic improvement. However, with this now looking to be underway, development intent is set to grow.”