The amount of office space in London’s West End occupied by hedge funds has doubled over the past 12 months from 25,000 sq ft to 58,000 sq ft, according to a new report from Cushman & Wakefield. Private equity take up remains level at 45,000 sq ft.

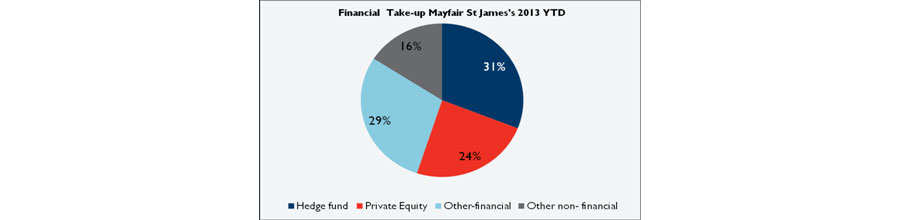

This recent surge in leasing activity is being driven by the growth of established funds such as BlueBay, Elliot Advisors and Highbridge rather than the emergence of start ups which remain low due to difficulty raising seed capital and a heightened regulatory environment. Amongst the alternative investment sector, hedge funds have been the most active in terms of leasing office space and currently account for 31% of take up this year to date.

Hedge funds continue to favour Mayfair and St James’, although Grade A options close by in western Soho and Marylebone will be considered.

The majority of hedge fund activity remains sub-5,000 sq ft with landlords responding by splitting floors at Devonshire House and 23 Savile Row with lettings to Beachpoint Capital at £110 per sq ft and Angelo Gordon and Viking Global at £107 per sq ft.

Vacancy rates for prime Mayfair & St James’s currently stands at 3.98%

Henry Peto, Partner at Cushman &Wakefield, said: “There is increasing competition within the alternative investment sector with hedge funds, private equity and wealth management companies all looking to secure first class office space. Vacancy rates continue to fall in Mayfair and St James’s with rumoured rents of £135 per sq ft being paid by Temasek at 23 King Street which is close to the peak of the last cycle in 2007.’’