Prime office markets showed a notable slowdown in Q2 2013, with China and Australian rents proving to be the most susceptible over the quarter.

Results for Q2 2013

• The Knight Frank Asia-Pacific Prime Office Index decreased for the first time since Q4 2009, ending a run of 13 consecutive quarterly increases

• Eight of the 19 prime office markets tracked saw prime rents decrease in Q1 2013, with 10 of the 19 seeing rents soften over the last 12 months

• Jakarta continued to see the strongest rental growth, with prime rents increasing by 12.4% in Q2 2013

• Despite the drop in the index, rents are expected to drop in only six of the 19 markets monitored over the next 12 months, with much dependant on the wider global economic landscape

Knight Frank’s Asia-Pacific Prime Office Index dropped for the first time in 14 quarters, decreasing by 0.1% over the quarter. This reflected a drop in demand from occupiers in a number of countries that are undergoing slowdowns or multi speed recoveries. Overall activity across the region has been down in 2013: net absorption in the major cities of Asia Pacific in the first half of 2013 was 22.8% lower than the same period of last year and 13.9% lower than the second half of 2012, with a number

of markets recording negative demand for the period.

In China, the general slowdown of the economy has trickled down to the office market, where prime rents in Beijing, Guangzhou and Shanghai declined over the quarter. The current rebalancing of the economy has caused some uncertainty and has impacted business expansions into new office space.

A key driver of the health of the Australian economy remains China, given the strong trade ties. With the Chinese slowdown, all major city CBDs in Australia are seeing negative absorption and declining effective rents in the lead-up to the election in September.

In Japan, the prime office rental market edged down slightly following two quarters of strong rental growth. The ongoing impact of “Abenomics” and the continuing move towards prime, earthquake tolerant office accommodation however is likely to ensure solid prime rental growth over the next 12 months.

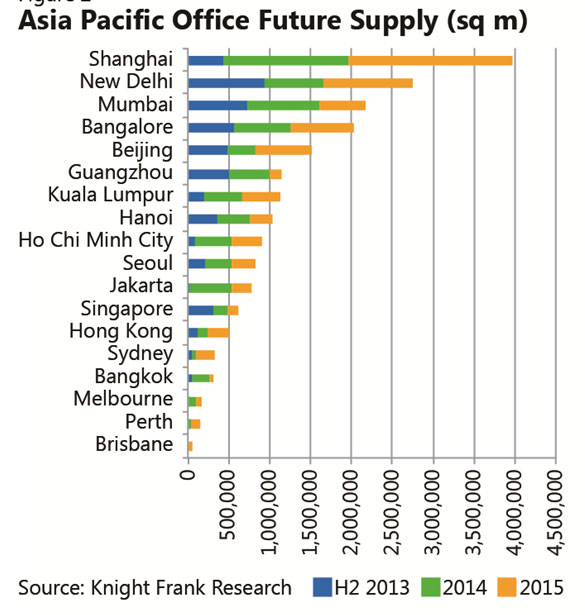

Similarly in India, rents have moved sideways and are expected to continue to do so, given the significant new supply that is expected to come online. With the expectation that markets are at the bottom of the rental cycle, prime rents remained stagnant in Seoul, Singapore, Kuala Lumpur and Ho Chi Minh City.

Other markets remain on the upward trajectory of the rental cycle, such as Bangkok and Jakarta, the latter continuing to be the stand out market with rents increasing by 12.4% over the quarter.

While the decrease in the index in Q2 is perhaps not too surprising, ultimately the office rental markets are driven by supply and demand. While demand is difficult to accurately forecast in these uncertain times, analysis on the future pipeline can be conducted to foresee the potential demand-supply imbalances which will impact rents going forward.