UK prime yields now stand at an average of 5.72% – the lowest point since October 2011 – after falling 5bp in July and 12bp over the last 12 months as a whole, according to data published today by Cushman & Wakefield (C&W).

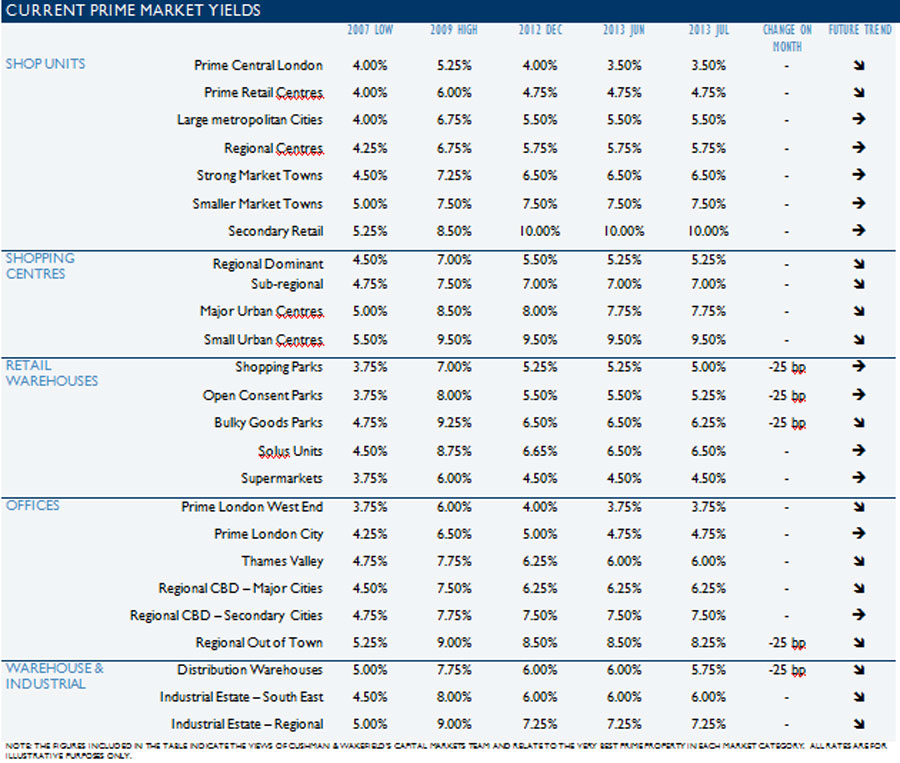

Sentiment has improved further with macroeconomic indicators firming and property expectations following suit. The anticipation of yields falling further, for example, is the strongest it has been since early 2010 with compression expected in 14 out of the 25 categories monitored by C&W (see Current prime market yields table below).

Last month’s drop in yields was led by the retail sector – and by retail warehouses in particular, which saw an average fall of 15bp. However, this partially reflects the bigger hit suffered by retail in the outward adjustment of yields in 2011 and 2012. Although retail yields are at a 16-month low, office and industrial yields are at levels last seen in 2007 and 2008 respectively; albeit in the case of offices this is very much driven by London rather than regional markets.

Investment volumes in the first half of this year were ahead for retail while Q3 has been strongest for offices so far, with London in particular set for a powerful performance.

Strong interest in prime assets is still underpinning demand across the market, helped by a stabilisation in government bond yields and ongoing low borrowing costs. However, a spreading of demand beyond core assets is becoming more prevalent in the market as buyers become more comfortable with higher levels of risk.

Cushman & Wakefield’s head of UK capital markets, David Erwin, said: “There is absolutely no doubt that there is optimism around the market which we haven’t seen for a number of years. The macro view suggests encouragement and at a micro level there’s a feeling that, particularly outside London, most of the rental bad news is out in the open and the occupational position improving. Capital is coming at us from a number of different directions and we can say, with some confidence, that pricing will firm up between now and the year end as evidenced by a spate of competitive bidding situations over the normally quieter summer months, particularly in the regions.”

Cushman & Wakefield’s head of EMEA research, David Hutchings, said: “Improving macroeconomic sentiment is being more than matched in the property sector and this is likely to accelerate in the second half of the year, helped by both improving demand and increasing supply.

“Indeed, with businesses and investors turning their thoughts away from merely surviving the storm to shaping their strategy for the future, we should be set to see greater corporate and investor activity in the second half of the year. Certainly among occupiers, however, a lot of this activity will be as much defensive as expansionary and we should also expect more business failures as banks relax support for the walking wounded and the economic recovery proves unforgiving for the unreformed, the out-dated and the inefficient.”