Take-up across the 11 markets rose to almost 1.38 m sq ft, the highest since Q3 2012 and 16% up on Q1 2013.

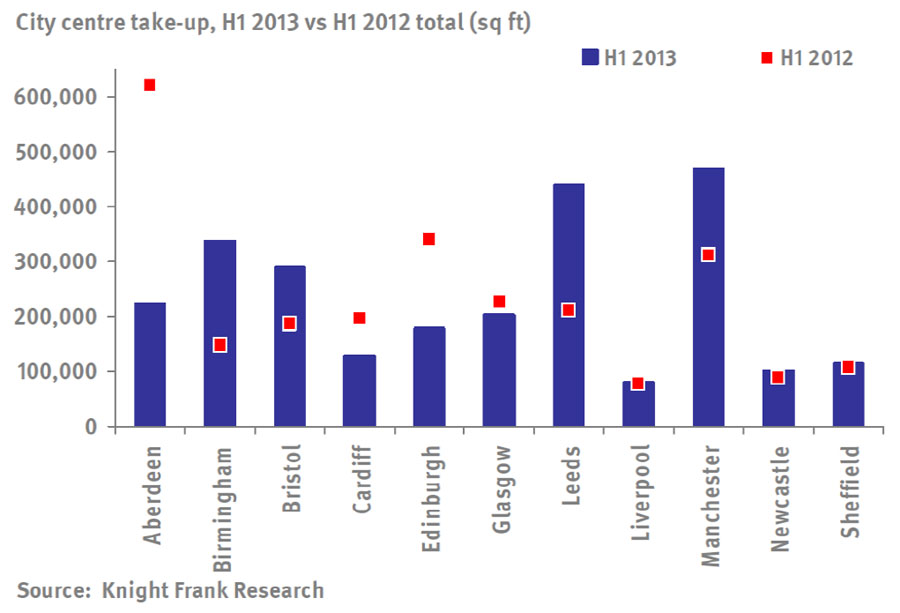

Whilst total take-up for H1 2013 stands 1.8% higher than H1 2012, this was largely due to Aberdeen’s exceptional performance in 2012. Indeed, the key markets in England, such as Birmingham (+128%), Leeds (+106%), Bristol (+54%) and Manchester (+51%) had exceptional take-up level during H1 2013.

Occupier demand is relatively robust for the regions, with a growing list of sizeable requirements, mainly from the big occupiers in the legal and financial sectors. Whilst there was a healthy level of activity, similar to previous quarter, transactions continued to be predominantly characterised by smaller deals.

Availability of Grade A space slipped to 2,831,975 sq ft in Q2 2013 – 15% down on Q2 2012. This reflects the continuing erosion of Grade A space in most markets in the absence of new completions/development activity.

Headline rents and incentives have been largely stable, with only Aberdeen showing an increase in headline rents (from £31.50 to £32.50) during Q2. While further significant growth in regional headline rents is unlikely over the remainder of 2013, net effective rents may harden as Grade A supply continues to decline.

David Porter, Partner, Head of Knight Frank’s Manchester office said: “The erosion of Grade A supply across all markets has seen a trigger in a number of enquiries from major occupiers. The fear of missing out on the selective deliverable development opportunities seems to be a catalyst to this. This said, landlords are still being very competitive in an attempt to regear leases and thus retain occupiers. We expect this trend to continue over what is now a ‘pre let market’, mainly due to the lack of speculative development across the regions.”

Investment turnover for offices outside London and the South East was subdued in Q2. The latest figures from Property Data suggest c.£346m turnover, 42% down on Q1.

Nonetheless, strong investor interest in prime office stock in the regions has been maintained, despite a shortage of suitable product (prime and long-income assets) remains a major barrier to activity. In the secondary spectrum, investor interest is highly selective, confined to good quality secondary stock where there is potential to add value through asset management.

Generally, prime yields were largely stable in the regional cities, albeit Q2 saw signs of improved sentiment for prime stock. Aberdeen, Birmingham, Bristol, Cardiff, Edinburgh, Glasgow and Leeds saw prime yields move in by 25bps.