Half way through the AGM season and research reveals that companies in the South of England have faced least dissent from their shareholders on pay and remuneration packages.

The remuneration team at KPMG in the UK has analysed shareholder voting at Annual General Meetings up to 31 May this year for 36 listed companies who have their head office in the South of England (excluding London). Using votes against the remuneration report of over 20% or votes against plus abstentions from voting of over 20% as the hallmark of significant shareholder dissent, they found the South has the lowest levels of dissent in the UK, with just 3% of businesses seeing 20% or more shareholders voting against remuneration packages. This is significantly lower than the national picture of 11%.

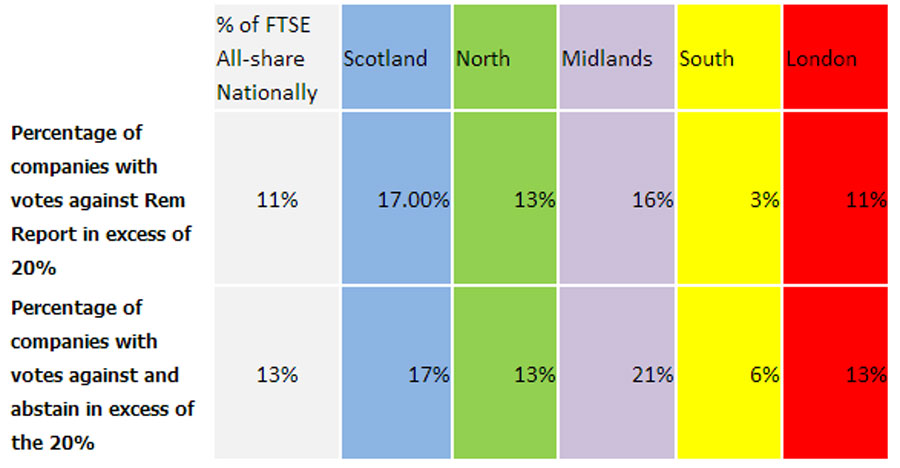

| % of FTSE All-share

Nationally

|

Scotland | North | Midlands | South | London | |

| Percentage of companies with votes against Rem Report in excess of 20% | 11% | 17.00% | 13% | 16% | 3% | 11% |

| Percentage of companies with votes against and abstain in excess of the 20% | 13% | 17% | 13% | 21% | 6% | 13% |

Phil Cotton, south region chairman at KPMG, said: “With over half of the voting season done, it seems fair to say that the ‘shareholder spring’ has not sprung in the South. Instead we have the lowest level of shareholder dissent on pay in the UK; where we have seen shareholders objecting, the dissent relates to specific circumstances and issues. These are usually not solely pay related, but instead driven by a combination of dissatisfaction around corporate performance and the leadership of the business.”

In KPMG’s view, this trend is likely to be the result of the efforts made by companies to improve their practices, procedures and communications on their pay policies.

Phil Cotton continued: “Spending more time and resources on shareholder communications is vitally important and these efforts appear to paying off for businesses in our region.”

The research also revealed that just over one in ten businesses in the South are ‘early adopters’ of new Business, Innovation and Skills (BIS) ‘two reports’ format on pay which will become mandatory next year.

The new BIS regulations coming into force next year will oblige companies to produce two reports on pay. One is a policy report which will require companies to set out their remuneration policy for the next three years for shareholder approval in what will be a binding vote, in contrast to today where the vote is advisory only. The second report is on the company’s implementation of existing remuneration practices and is backwards looking. Here the vote remains advisory.

According to KPMG’s research, early adoption of this new format is slightly above the national figure, with 11% of businesses saying they had implemented the main elements of the new regulations.

These are:

- The two report format, which splits the report into a policy and an implementation report

- The table of the elements of pay, which sets out each element of remuneration, its purpose and link to strategy

- The scenarios graphs, which set out what each executive director would receive in the event of “minimum performance”, performance in line with budget/plan, and outperformance

- The single figure of total remuneration, which sets out the total aggregate remuneration received by each director during the past year.

| % of FTSE All-share

Nationally

|

Scotland | North | Midlands | South | London | |

| Adoption of main elements of new BIS regulations | 10% | 10% | 23% | 10% | 11% | 9% |

“We have seen a steady increase in enquiries from small caps asking for help in preparing for the new ‘two reports’ format. Particular challenges they face are:

- Clearly linking the elements of pay to strategy

- Formulating a policy that shareholders will approve but gives the Remuneration Committee sufficient flexibility and the ability to exercise discretion when needed; and

- Producing the required information in the prescribed format.”

Whilst a shareholder spring has so far been averted this year, South businesses are not out of the woods yet. Shareholders will continue to keep a keen eye on remuneration agreements over the forthcoming year, warns Phil Cotton: “Whilst this year we have seen a small number of cases where shareholders focused their attention, we expect the issue of remuneration to be a future bone of contention. Companies now face a triple challenge:

- Shareholders being more willing to challenge poor remuneration practices and corporate underperformance in what remains a challenging economic environment.

- The need to replace a large number of long-term incentive plans in the next few years.

- The requirement to adopt BIS’s new remuneration reporting requirements by next year.

“These factors mean that the focus on remuneration will continue.”