The real estate correction is now over for core assets, abrdn forecasts, as it expects residential, retail and industrials to outperform. The UK is leading the way on this global recovery, buoyed by the result of the General Election which means the country could now arguably be seen as a bastion of relative calm in a more complex global political environment.

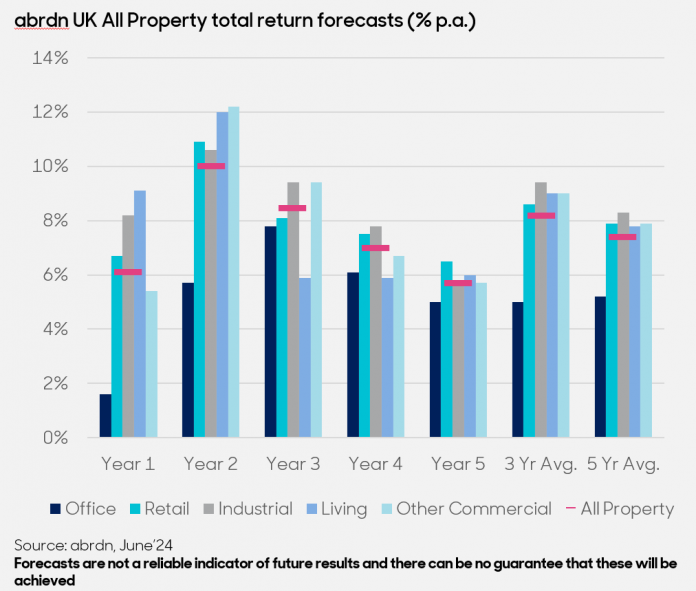

abrdn has upgraded its investment view on real estate from underweight to neutral – and is overweight on sectors such as residential, industrials and retail. Overall, it expects total returns from UK property to average 8% per annum over the next 3 years – although forecasts are no guarantee of future results.

While the wider real estate market has focused on “value add” investment, abrdn believes that “core” (i.e. prime) real estate will deliver the most appealing opportunities. It is forecasting further valuation falls among lower-quality real estate assets, as the cost and time to redevelop weaker properties remains a challenge.

Anne Breen, Global Head of Real Estate at abrdn, says:

“We believe that the real estate sector has now mostly repriced following readjustments as the era of cheap debt came to an end. As a result, we have now upgraded our house view on real estate to neutral after being underweight for around two years. Essentially, we think it is no longer the time to be underweight to real estate versus other asset classes.

We believe this real estate cycle is very different to previous ones, as rental income from property has not been challenged in the way it was before. That means the recovery for future-fit buildings should be faster – boosted by lack of high-quality supply.

However, not all sectors are made equal. We particularly like residential, because of supply-demand imbalances; industrials and logistics – due to the need for modern warehousing to support global and local distribution; and some areas of retail that have benefitted from changes to the way we shop since the pandemic.

We are more cautious than most on offices. In our view, a small proportion of the market (i.e. prime central locations) will do very well, but for a large part they face higher tenant churn and more capital expenditure requirements – with large pools of global capital looking to reduce overall exposure to the sector. We therefore advocate a very cautious and selective approach.”

abrdn is particularly positive on residential and industrials as well as some areas of retail – where it expects to see above-average returns compared with the property sector as a whole. Offices, by contrast, are forecast to underperform the sector average.

Crucially, within sub-sectors sentiment varies. Retail parks have jumped from 33rd in March 2020 to 3rd out of 34 in abrdn’s ranking of the real estate asset classes expected to deliver the best 3-year returns. Standalone “solus retail warehouses” have jumped from 30th to 15th.

However, abrdn is much less positive on other areas of retail, such as high street shops or weaker shopping centres, which face ongoing challenges to stabilise net cash flows.

Income remains the key driver of returns and abrdn is seeing some real estate yields hit decade highs. The average yield on prime property in the UK and Europe is now at 5.7%, up from 4.2% at the previous peak in June 2022. This represents an appealing cashflow for investors compared to interest rates on cash and yields on Eurozone and UK government bonds, which are currently at 3.1% and 4.1% respectively.

The UK appears to be leading the global real estate recovery among developed countries. Rolling annual returns for UK real estate are almost back to positive territory – while globally they remain down by 5% according to the latest MSCI data to Q1 2024.

Returns on real estate in Asia Pacific are lagging the global cycle, with China still battling a real estate depression and the Bank of Japan raising interest rates as most other developed markets begin to make cuts.