Kieran Farrelly, Head of Global Solutions, Real Estate, at Schroders Capital, reveals how to harness long-term real estate opportunities in today’s market conditions.

Real estate markets across the world have been hit hard by the higher interest rate regime and disruption in capital markets. In our view, this is creating a compelling window of opportunity for investors owing to the following:

- A significant but uneven rebasing of values has led to highly attractively repriced assets becoming available across a variety of markets and sectors.

- Current market dynamics, including debt capital availability and the impact of tighter regulations, are acting to further increase the availability of repriced opportunities.

- Underlying operating fundamentals in many sectors remain supportive as new supply is largely constrained beyond this year and next, owing to elevated debt finance and construction costs.

- With pricing expected to bottom out, we believe funds deploying into this market are set to be outperforming vintages as historically seen for funds investing into such periods.

Having previously explained the sequential opportunity on the horizon in the market we now believe that this has “gone live” due to the extent and uneven pattern of the repricing experienced to date. In our view, investors should now position themselves to capitalise on opportunities as they emerge across markets, sectors, and investment structures.

The repricing to date and the sequential playbook

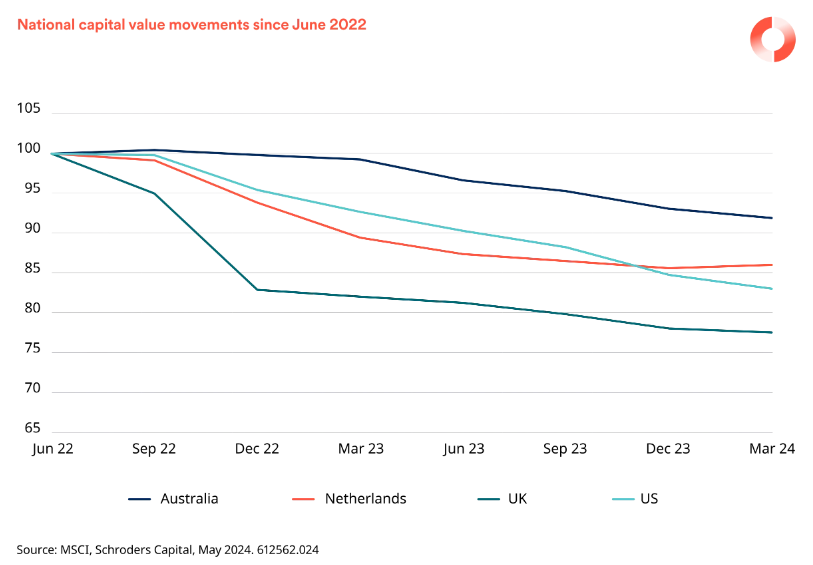

The impact of higher interest rates, alongside uncertainties concerning the broader macro environment has fed through to upwards yield or cap rate movements – resulting in a rapid repricing across markets and sectors since end June 2022. This is illustrated by four developed markets which have seen significant movements in a relatively short space of time.

Given this, our market valuation framework is signalling immediate opportunities in markets that have experienced the fastest repricing. Immediately, this points to the UK and Nordic region, followed by the US and other Continental European markets which, in our view, have either fully or have almost sufficiently adjusted to a higher interest rate regime. In the Asia-Pacific region, cyclical opportunities are available in markets that align with China’s delayed recovery and/or offer alternatives in the nearshoring/friendshoring of supply chains.

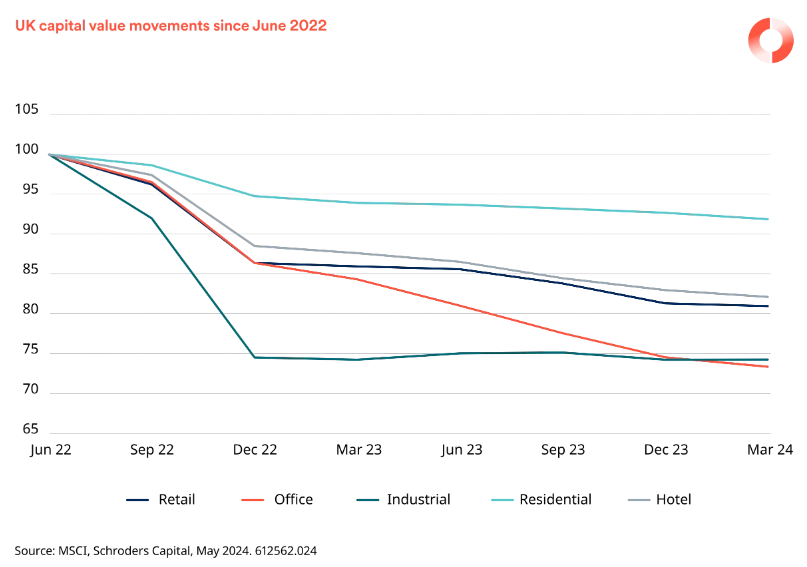

But geographic ordering is only part of the story, as the performance of sectors has diverged materially as well. Taking the UK as an example, we can see a trend playing out globally.

Generally, property types providing contractual or indirect inflation protection continue to be of most interest. Industrial and logistics assets, for instance, have repriced significantly and appear to be stabilising, while remaining supported by structural, long-term fundamentals.

In addition to the repricing, the new higher interest rate regime now makes financial engineering less feasible, with investment performance instead centred on effective operational management in sectors able to provide real growth. This remains our focus and includes hospitality, self-storage, and a variety of “living” segments.

Market dynamics

Alongside the ordering opportunities across geographies and sectors, private real estate investors also stand to benefit from advantageous pricing across several investment structures. For example, there is a live opportunity in real estate secondaries where institutions are disposing of holdings for a variety of reasons. Often these have little to do with the prospects of the underlying asset class and more to do with broader portfolio rebalancing considerations. Consequently, materially discounted secondaries opportunities exist, for example in the UK, owing to a slew of motivated defined pension plan sales, and more selectively on a global basis for open-ended vehicles with sizeable redemption queues.

We also note a growing number of management teams seeking capital solutions to de-lever their balance sheets to withstand a higher interest rate environment and/or facilitate growth. Stalled transaction and (debt) capital markets hinder managers’ ability to raise capital for growth and/or prop up balance sheets, thereby creating situations where capital is required to provide liquidity to private funds, companies, and other vehicles.

On top of the capital market disruption, the consequences of building sustainability regulations and shifting occupier preferences have been coming to the fore. Meeting these new requirements and expectations is highly capital intensive and this has come at a time when debt capital is restricted. The confluence of these factors is providing a significant “value add upgrading” opportunity to bring properties up to modern standards that meet the requirements of regulators and occupiers alike.

Sound underlying operating fundamentals

In most markets, income has been rising amid both the value adjustments we have seen and muted economic conditions. This underscores how the epicentre of recent market movements has been primarily a capital markets story, which has been somewhat dislocated from the underlying property fundamentals, bar in the much-maligned office sector. Indeed, fundamentals across most sectors have generally held up much better than expected outside structural challenges.

While demand is experiencing the general headwind of anaemic economic growth like many segments of the economy, tight supply conditions (due to higher construction and debt finance costs) mean a scarcity of high-quality ESG-compliant spaces will support an upward trend in rents, once economic growth resumes through 2024 and into 2025. More broadly, secular trends – which we at Schroders refer to as the “3D Reset” – to group demographic shifts, deglobalisation and decarbonisation efforts, are highly concentrated in real estate markets. These provide some substantial tailwinds to the long-term prospects for specific sectors that extend far beyond today’s market dynamics.

What does history tell us?

In addition to fundamental analysis and pricing stabilising, historical trends suggest that markets tend to rebound after downturns. This is evident in the performance of private equity real estate funds, where investment opportunities following price corrections have historically yielded above-average returns.

For many years, institutions have used the full suite of options in the real estate markets to gain exposure to the benefits of the asset class. As specialisation and deep resources are key to the best outcomes, global real estate has been relatively underexplored by individual investors.

Today, multiple structures make private assets more accessible to individual investors, at a time when traditional institutional vehicles are expected to begin to restart their engines.

Taken together – increased access to the long-term portfolio benefits of the asset class combined with the current sequential opportunity emerging today – offers private investors an exciting entry-point to the potential for the global commercial property sector.