Private markets are entering Q2 2024 with a reshaped investment landscape. The normalisation of fundraising and valuation adjustments for specific strategies have set the stage for promising investment opportunities, explains Nils Rode, CIO, Schroders Capital:

Investments that align with the global 3D Reset theme and the ongoing AI revolution are particularly appealing. Additionally, the potential further easing of inflation and anticipated interest rate cuts can create short to mid-term tailwinds. Yet, with continuing political tensions both within and between countries and escalation risks for ongoing conflicts, diversification within private market allocations remains key.

As we approach Q2 2024, private markets have largely reverted to pre-pandemic levels in terms of fundraising, investment activity, and valuations, creating a favourable environment for new investments. However, in 2023, fundraising remained concentrated on large funds, which is one of the reasons why we see more attractive opportunities for small and mid-sized private market strategies. This is especially the case for private equity, where buyout fundraising for large funds reached record levels while the rest of the market stayed at healthy levels.

Historically, fundraising has served as a valuable contrarian indicator. This is because most private market strategies are closed systems where fundraising levels and dry powder directly influence entry valuations and, in turn, impact vintage year return expectations.

We find private market investments that align with the 3D Reset (decarbonisation, deglobalisation, demographics) and the AI revolution particularly attractive. For instance, in infrastructure, the energy transition segment stands out due to the push for decarbonisation and concerns about energy security. Its strong correlation with inflation and secure income traits further contribute to this asset class’s growth.

Income has become particularly appealing across most markets, with private debt and credit standing out. We favour investments that benefit from market inefficiencies, focusing on fundamentals over distressed assets.

Although interest rates are likely to remain higher for longer, we anticipate that easing inflation and potential interest rate cuts will provide a tailwind for private market investments in the short to mid-term. This is especially true for real estate, where significant valuation corrections have occurred, and our proprietary valuation frameworks suggest that 2024 and 2025 may be attractive years for new investments.

While our private market investment outlook is generally positive, we believe that given ongoing geopolitical risks and domestic political tensions as well as escalation risks from ongoing conflicts, it’s essential to maintain high selectivity and robust diversification within private market allocations. In the following, we highlight the most attractive opportunities within each private asset class.

Private equity

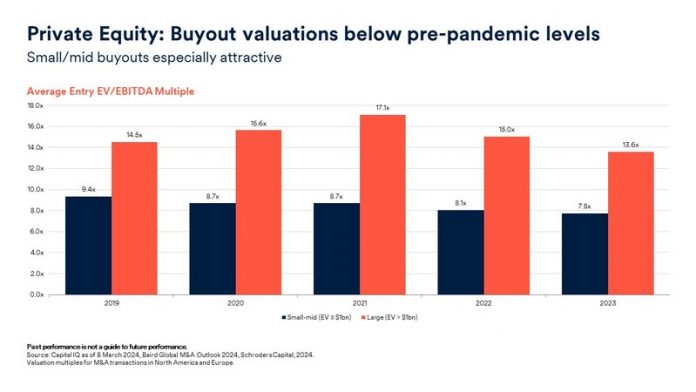

In 2023, buyout fundraising, propelled by larger funds, reached a record high, while growth and venture fundraising have not yet recovered to pre-Covid levels. A sustained decline in deals and exits led to lower buyout valuations.

We advocate for a highly selective approach to private equity investments, focusing on opportunities that resonate with global trends and can capture a complexity premium.

We favour small to mid-sized buyouts over larger ones due to a more favourable dry powder environment and a valuation discount of around 6x EV/EBITDA. Small and mid-sized buyouts also have an additional exit strategy — selling their portfolio companies to larger buyout funds.

Co-investments are attractive as they address a critical need in capital structures, especially as banks have withdrawn from the lending market and deal leverage has reduced. Deals involving structured equity and preferred equity can present particularly beneficial risk-return profiles.

We anticipate GP-led transactions will excel in the current exit-stressed market. Single-asset GP-led investments, often centred on standout portfolio companies, are particularly intriguing. These transactions can offer shorter holding periods and higher upside potential with lower loss ratios than traditional LP-led secondaries.

We believe seed and early-stage venture will be a driver of the current wave of AI innovation, disruptive energy technology, and biotechnology. Early-stage investments benefit from a disciplined fundraising environment, which results in more conservative entry valuations. Late-stage or growth investments face higher refinancing and valuation risks due to a drop in venture capital fundraising and a yet-to-reopen IPO window.

Regionally, North America, Western Europe, China, and India are appealing. We view India’s private equity market as particularly promising due to its robust long-term economic growth prospects, a rapidly growing private equity industry, and a broad spectrum of high-growth private companies.

Private debt and credit alternatives

Income has become highly attractive across most markets. Despite peaking interest rates in developed markets, we anticipate they’ll remain higher than levels seen in the past two decades, suggesting an opportunity to reallocate to income.

With banks, especially in the US and Europe, retreating, there’s a significant risk premium available beyond rates. As risk premiums in the liquid debt market have collapsed, private debt and credit appear very attractive.

We favour investments offering high income and benefiting from capital provision inefficiencies. These include:

- Defensive income from infrastructure debt with stable, low-volatility cash flows.

- Opportunistic income from sectors with distress that causes emotional bias, like real estate debt.

- Uncorrelated income from sectors such as insurance-linked securities.

- Diversifying income capitalising on changes in bank regulation, like asset-based finance, or sectors with limited capital access, like microfinance.

Our focus is on fundamentals rather than distressed assets. We prefer areas where distress has created emotional bias in otherwise healthy asset sub-sectors, avoiding areas with unresolved fundamental challenges. With many syndicated markets rallying in Q4, yield spread premiums have significantly reduced, even in previously cheaper liquid markets like CLOs (collateralised loan obligations) and ABS (asset-backed securities). Today, most liquid markets are historically tight in terms of risk premium. Only Agency MBS (mortgaged-backed securities) and non-syndicated MBS/ABS as well as specialized sectors, such as insurance-linked securities, offer value.

Insurance-linked securities provide valuable portfolio diversification due to their lack of correlation with macroeconomic conditions and offer attractive returns due to higher yields driven by reinsurance limitations.

The growing interest in income allocations and maturity of private debt allocations have created a need for diversification. Asset-based finance is a key area of inquiry due to its diversity and the benefits of Basel III impacts in the US. Opportunities within this sector span equipment, consumer, and housing, and can be accessed directly, via financing, or through risk transfer mechanisms such as bank capital relief.

As investors face extensions in their traditional private debt book’s maturity, strategies generating cash flow, particularly with near-term income or capital return – as is the norm in asset-based finance – are in greater demand.

Infrastructure

In the realm of infrastructure, we find the energy transition segment particularly compelling due to its strong correlation with inflation and secure income traits. It also aids in diversification through its exposure to distinct risk premiums, such as energy prices.

The push for decarbonisation, coupled with growing concerns about energy security and the need to reduce dependency on fossil fuels, further amplified by the ongoing conflict in Ukraine, benefits renewable energy. The cost-of-living crisis has also spotlighted the issue of energy affordability. In many regions globally, renewables have become the most cost-effective option for new electricity production. These macro trends support the future growth of this asset class.

Currently, with a base of approximately €600 billion installed in Europe, renewable energy accounts for 40 – 45% of infrastructure transactions. Projections suggest that by the early 2030s, renewables could more than double to €1.3 trillion. This suggests that in the future, renewables, and more broadly, infrastructure related to the energy transition, could make up the majority of investable assets within the infrastructure sector.

Renewable-related technologies, such as hydrogen, heat pumps, batteries, and electric vehicle charging, will play a crucial role in facilitating the decarbonisation of sectors like transport, heating, and heavy industries.

At present, there is a significant gap between the high volume of renewable projects and the limited capital investment. This, combined with rising interest rates, has led to a re-evaluation of expected returns, rendering the current market environment an attractive entry point, especially for core/core+ strategies. Simultaneously, the asset class has demonstrated resilience as the link to inflation and exposure to merchant price have bolstered the strong performance of existing portfolios in 2023.

Real estate

The real estate market has been experiencing value corrections, with varying degrees of adjustment across different regions, sectors, and investment structures. This presents an opportunity for sequential access to attractive repricing. Our proprietary valuation framework suggests that 2024 and 2025 will be opportune years for real estate investment.

Occupational markets remain robust, with expected growth in most real estate sectors, particularly those with structural support. Despite softer demand, tight supply conditions due to increased construction and debt finance costs maintain sustainable rental income levels. The lack of high-quality ESG-compliant spaces will stimulate rental growth post-economic recovery.

Opportunities are emerging from debt capital market illiquidity, including those requiring capital solutions for balance sheet adjustments. Refinancing waves are anticipated to accelerate these opportunities amid further price discovery in 2024.

Immediate opportunities are present in markets with rapid repricing, such as the UK and Nordic region, followed by the US and other Continental European markets. In Asia-Pacific, cyclical opportunities that align with China’s delayed recovery or nearshoring/friendshoring of supply chains are attractive.

Industrial and logistics assets have rebased to attractive price points in most submarkets, backed by strong fundamentals. We favour operational properties with strong demand-side tailwinds and direct or indirect inflation-linked income potential.

The current environment reinforces our focus on operational excellence for long-term, sustainable income and investment outperformance. We believe all real estate has become operational, aligning the financial outcome of investments with the success of tenants’ businesses within these assets.